“I am not the only one who can see the absurdities of our foreign policy. We give $3 billion to Israel and $12 billion to her enemies. Most Americans know that makes no sense"Unfortunately, Dr. Paul is wrong. Most Americans could care less about our foreign policy, and those that do tend to agree with giving military and economic aid to foreign countries.

Check out Peter Schiff's recent appearance on CNBC:

Key quotes:

We are underweight both the euro and the yen. But the problem is, as bad as the situation is in Europe and Japan, it is worst here. We owe Japan 1 trillion dollars. We're in much worse shape than Japan. They still have big exports, they have high savings. We`ve got this complete phony economy.

The idea is, people thought that QE2 was training wheels on a bike. The Federal Reserve was putting training wheels on the economy, and as soon as the economy could go on its own, they would take the training wheels off.Strange how Schiff doesn't mention the excess reserves the Fed is holding and the potential to release them into the money supply. Perhaps that will be the QE3.

QE2 isn't the training wheels, it's the only wheels. If you take QE2 away, it will implode. As soon as the market figures that out, that that's the situation our economy is in, that it's completely addicted to zero percent interest rates and endless quantitative easing, that is a major, major problem for the dollar in our economy. QE2 ending is dollar positive but it's not going to end, it cannot end. We'll be in worse financial shape than 2008.

Is this perhaps a preview of what Obamacare will look like:

(Guardian) Doctors are blaming financial pressures on the NHS for an increase in the number of patients who are not being treated within the 18 weeks that the government recommends.It looks like Zimbabwe is going through with their plans for a gold-backed currency:New NHS performance data reveal that the number of people in England who are being forced to wait more than 18 weeks has risen by 26% in the last year, while the number who had to wait longer than six months has shot up by 43%.

HARARE (Commodity Online): Zimbabwe may sell diamonds for gold, so that it can have a gold-backed currency, according to a recent proposal from the governor of Zimbabwe’s central bank.China seems to be following suit:

The Zimbabwean dollar is no longer in active use after it was officially suspended by the government due to hyperinflation. The United States dollar, South African rand, Botswanan pula, Pound sterling, and Euro are now used instead. The US dollar has been adopted as the official currency for all government transactions with the new power-sharing regime, says Wikipedia.

China Becomes World’s Larest Gold Buyer - Buys 93.5 Tonnes of Gold Coins / Bars in Q1 - Gold Ownership Rising From Miniscule LevelsSo is it a good time to be bullish on precious metals? Marc Faber and Schiff have contradicting views, but are still long on precious metals. From Faber:

Gold and silver are higher again today with the debt laden dollar, euro and yen all being sold. News that China has become the world’s largest buyer of gold bullion and has seen investment demand double continues to reverberate in the markets and may have contributed to this morning’s strength.

"As we reported earlier (Beware the False Breakout in Stocks) Marc Faber had turned somewhat cautious regarding the precious metals as they were overbought and facing the upcoming weak seasonal pattern."Schiff on silver:

“I think it’s a buying opportunity. I do believe the U.S. economy is slowing down, in fact I think it’s going to slow a lot more than people realize. But for that reason, I think that quantitative easing will not end over the summer. In fact, I think the Fed is going to step it up. QE3 could be even bigger than QE2 and that’s very bullish for precious metals and very bearish for the dollar.”Precious metals may be seeing a sell off shortly, but if QE3 comes (which it will in one way or another), it will end quickly.

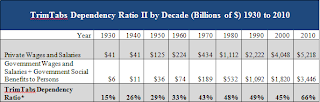

Mish has a good post highlting some charts from a new TrimTabs report. Check this one out on government dependency ration:

We are introducing the TrimTabs Dependency Ratio II, which adds income from government wages and salaries to income from government social benefits and compares it to income from wages and salaries. This modified ratio rose to 66% in March, from 33% in 1960 and 45% in 2000.

The principal driver of the increase in TrimTabs Dependency Ratio is the rapid rise in government wages and salaries and social benefits over the past decade. From 2000 to 2010 private sector wages and salaries grew 29%, whereas government wages and salaries plus social benefits grew 89%, nearly three times the growth rate of private sector wages and salaries.And I will end with this video showing humanity's uncanny ability to adapt and look for opportunities to serve customers no matter what obstacle:

The government is playing an increasingly dominant role in the economy by borrowing massive sums to fund social welfare programs. This borrowing is financially unsound if not morally wrong. Instead of creating new wealth, it is simply piling more debt on an economy with the same capacity. At some point, the carrying capacity of the economy will be exhausted. We believe the economy is at or near that point.

Call it capitalism.

Tidak ada komentar:

Posting Komentar