ATHENS/BERLIN, May 6 (Reuters) - A small group of European finance ministers was meeting on Friday to discuss the euro zone debt crisis, official sources told Reuters, as Greece denied a media report that it was considering whether to leave the bloc.You know damn well that kicking Greece out is being considered by some. Officials can deny it all they want but eventually the market will make the decision for them.European official sources told Reuters that finance ministers from a handful of the largest euro zone countries were meeting privately in Luxembourg to talk about issues including the severe sovereign debt problems of Greece and Portugal.

On the issue of the U.K., which still has its own printing press and currency, Jim Rogers made a surprising claim today:

Britain isn’t cutting its structural deficit by enough or doing it quickly enough and may need a bailout from its European partners, investor Jim Rogers told CNBC.

But UK-based analysts disputed this view, saying the austerity measures were enough.I doubt a bailout of the U.K. will happen but it may opt for devaluation in the end. Rogers also has a take on the U.S. federal debt, saying what we all already know:Rogers said the UK coalition government needed to go further in order to avoid financial catastrophe.“They [the government] are not doing it. They are saying they are doing it but they are not. They are saving £1 billion ($1.6 billion) here or there but they are not doing what they really need to and I’m not sure the government would survive the kind of pain that is really required," he said.

Around 1918, the UK went into decline. By the mid 1970’s, it was bankrupt. Starting in 1979, it experienced a bounce-back rally of sorts – thanks to their oil fields in the North Sea. Most people give Maggie Thatcher credit for their comeback, but the real white knight for the UK was the North Sea oil discovery,” he said.Bill Gross is even hinting at buying U.S. Treasuries again. From Reuters:

You give me the largest oil field in the world, and I’ll show you a good time too. But the US would need four or five North Sea oil fields to save the current situation...because the Federal debt is unpayable.

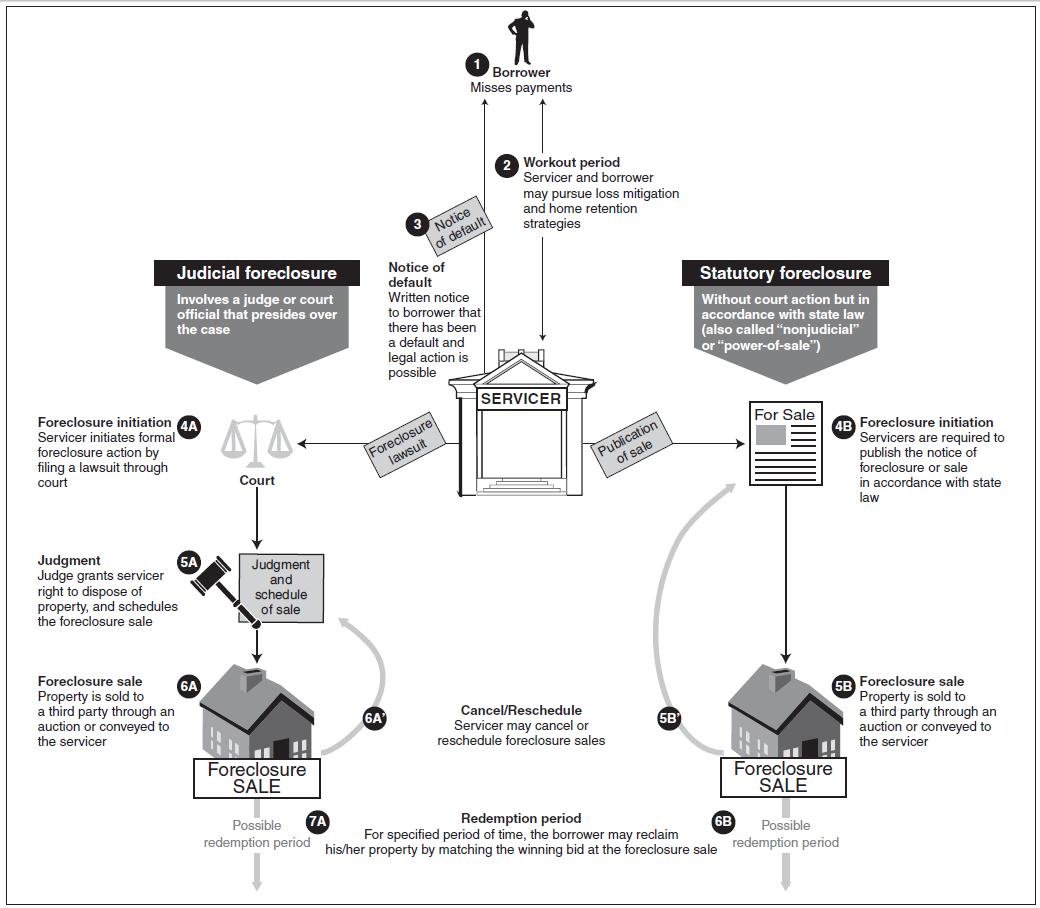

PIMCO's Bill Gross, who runs the world's largest bond fund, said on Friday the only way he would reverse his "short" position on U.S. government-related bonds and purchase Treasuries again is if the United States heads into another recession.I will end with some cool charts. First is the foreclosure process from a new GAO report:

And here is another sign of the higher education "bubble" via Mark Perry:

Thank God for Amazon.com and the fact that I am graduating.

Update-Here is a video clip collage of Ron Paul from last night's debate:

Tidak ada komentar:

Posting Komentar