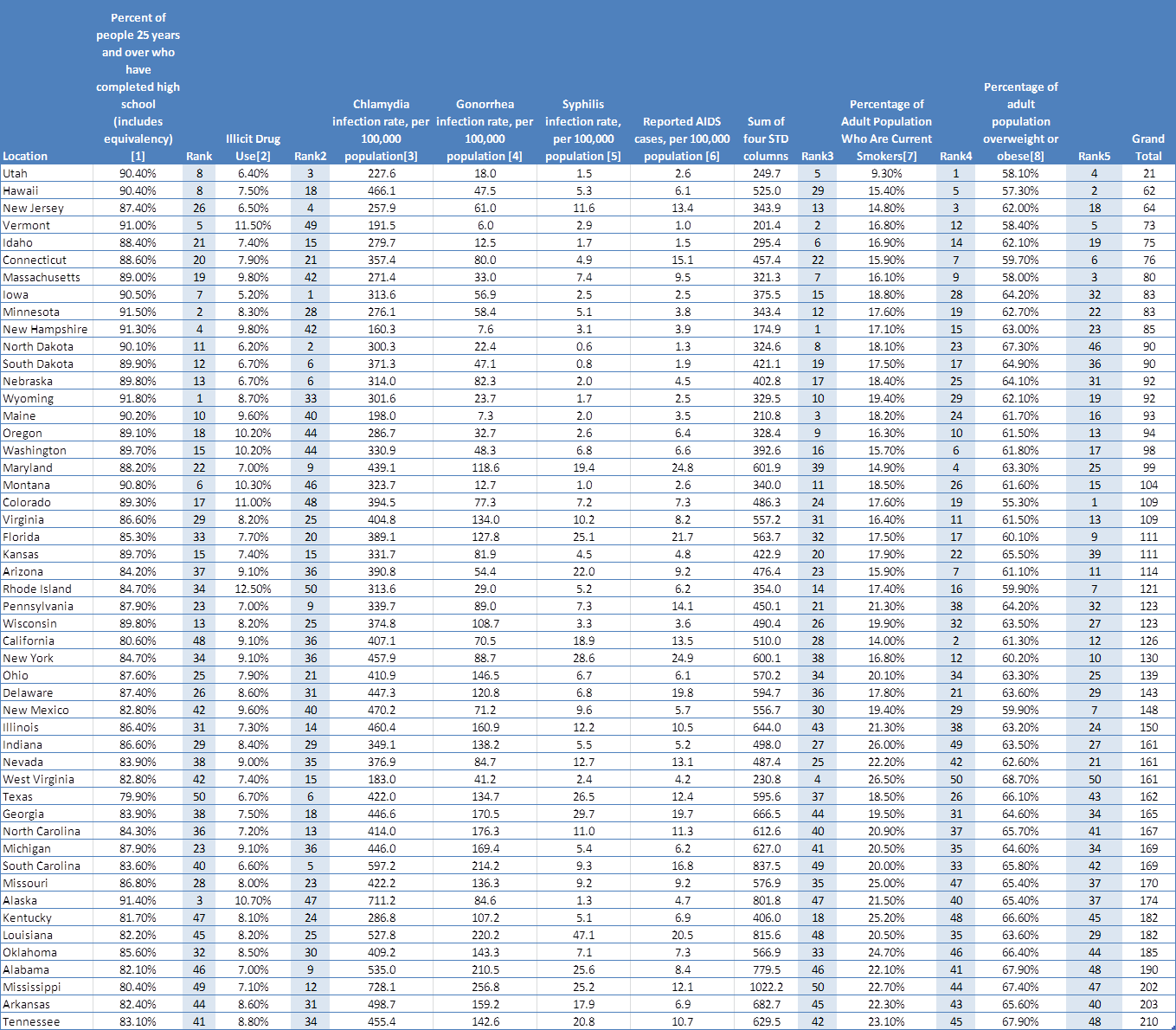

Who ranks lowest in high school graduation rates? Texas at 79.9%.

Who ranks highest in illicit drug usage? Rhode Island at 12.5%.

Who ranks highest in reported cases of a sexually transmitted disease (chlamydia, gonorrhea, AIDS, and syphilis) per 100,000 people? Mississippi at 1022.2.

And who ranks highest in number of adult smokers? West Virginia at 26.5%

So go to Rhode Island if you want the good stuff, don't got to Mississippi if you want a hooker, don't got to West Virginia if you have asthma, and don't go to Texas for academic enlightenment.

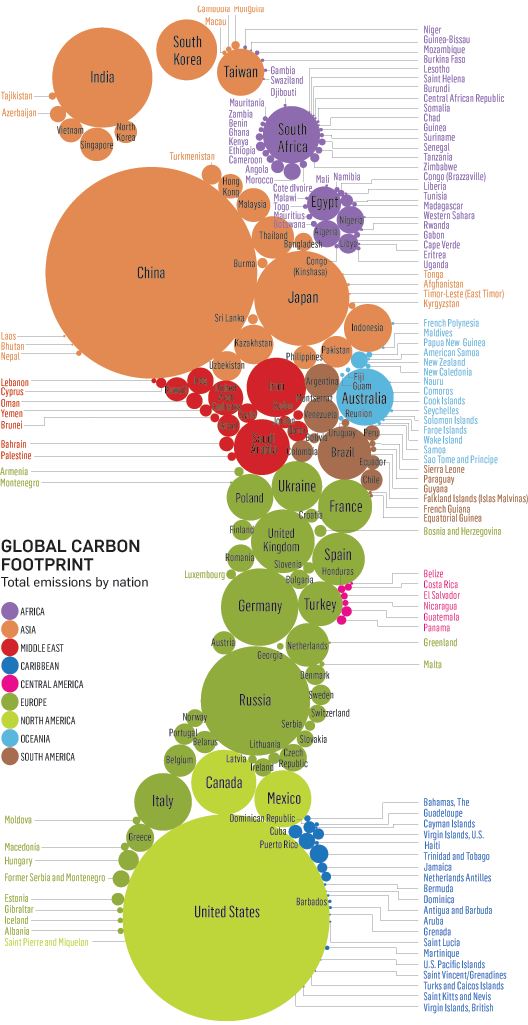

Here is another great chart from Ritholtz on which country's have the biggest carbon footprint:

No surprise there.

And here is a chart from the American Petroleum Institute on which states have the highest gas taxes:

Well would do you know, California, New York, Hawaii, Illinois, and Massachusetts come out on top. Didn't see that coming...

And now EPJ is reporting that New York is seeing 14% inflation from a year ago.

Yesterday, the Wall Street Journal reports that:

In the coming months, hundreds of thousands more will drop off the unemployment rolls. The number of people using up their regular 26 weeks of unemployment payments peaked in August 2009 at nearly 800,000 a month. That means a lot of people should be hitting their 99-week limit right about now. And unless Congress does something unexpected, more people with shorter bouts of unemployment will start joining them as the government phases out extended benefits next year.As the number of 99-weekers leave the unemployment rolls, expect the rate to jump as they start looking for jobs again. At least Bernanke's money printing is beginning to have an impact for some:

Los Angeles-based CB Richard Ellis Group Inc. said income from arranging property sales grew robustly, led by strong activity in Asia and North America. Revenue from brokering leases also rose, posting gains on top of a solid quarter a year earlier.Remember some of those who claimed that the earthquake at Japan would be great because of the increase in government spending? Well check this out from Bill Buckler:

"This year's first quarter comes against a backdrop of steadily improving market fundamentals globally," Chief Executive Brett White said in a statement. "Looking ahead, general market trends remain favorable with rising transaction activity and improving fundamentals across most of the world."

1 quadrillion!? Paul Krugman is surely getting a thrill up his leg for Japan. Just imagine all of that government spending and holes that can be dug and filled up again! I highly doubt the market will stand for the kind of debt though, which may prove disastrous for the government's bond market. Look for the IMF and World Bank to step in. (And of course major Central Banks.)The latest projections from the Japanese Finance Ministry regarding the fiscal year which started on April 1 make for sobering reading. They say that Japan’s “public” (funded) debt will probably rise by 5.8 percent this year - to 997.7 TRILLION Yen ($US 12.2 TRILLION at current exchange rates). Should these projections be even slightly on the optimistic side - and government financial projections always are - then Japan could easily be looking at a public debt of 1,000 TRILLION Yen by March 31, 2012.

There is another way of expressing 1,000 TRILLION. It is the same as ONE QUADRILLION.

The sheer magnitude of these numbers has long been a talking point for the watchers of international finance. Now, they are becoming very nervous indeed. The OECD has recently “urged” the Japanese government to “do something” about their deficits, especially in the wake of the earthquake disaster. Noting that Japanese sovereign debt is about to hit 204 percent of GDP, they suggested that Japan’s current sales tax be “at least” doubled from its present 5 percent to 10 percent. The Japanese Foreign Ministry politely declined to comment on this suggestion, contenting themselves with assuring the OECD that - “We will continue to work to maintain and secure trust in Japanese government bonds.”

Yesterday, I brought up Mark Perry's blog post on our decreasing manufacturing and his myth busting of the decrease being due mainly to outsourcing to countries with cheap labor. He proves his point even more today that as a country, we no longer require as much domestic manufacturing because of our increased productivity:

So Doug French points out in a recent Mises Economic Blog post that Justin Bieber's brand may be in the midst of an asset bubble:..here's some perspective from Chicago Fed economist William Strauss, who explains how rising worker productivity (see chart above) has contributed to that trend:"In 1950, the manufacturing share of the U.S. economy amounted to 27% of nominal GDP, but by 2007 it had fallen to 12.1%. How did a sector that experienced growth at a faster pace than the overall economy become a smaller part of the overall economy?The answer again is productivity growth. The greater efficiency of the manufacturing sector afforded either a slower price increase or an outright decline in the prices of this sector’s goods.

Clearly the Justin Bieber asset bubble popping will plunge us into another "Great Recession," but it may be more worse than the last one. Hopefully it will translate into silver prices skyrocketing.JUSTIN BIEBER

Increase in Bieber’s Twitter followers over the past year, to almost 9 million: 450%Why It’s a Bubble: Someone paid $40,668 for the heartthrob’s hair clippings in a charity auction this year.

Not to Worry: L.A. Reid, the head of Island Def Jam, predicts Bieber “will go beyond the teenage puppy-love thing.”

Tidak ada komentar:

Posting Komentar