I intend to impact campaigns all across the country -- starting now. After witnessing firsthand the incredible support to take back Washington for the ideas that you and I hold dear, the time has come to channel our political energy toward candidates who are our best hope.Besides Ron Paul and maybe Gary Johnson, who else Schiff will support is beyond me. Hopefully it won't be anyone who supports this unbelievable claim:

Make Schiff Happen aims to be the “gold standard” of fiscally conservative political action committees. It will focus on shrinking the public sector so that the private economy may prosper, and will endorse VIABLE candidates with the economic know-how to save America before it's too late. I've spent years working to secure my credibility; you have my word that I won’t lend it out to just anybody.

WASHINGTON, May 4 (Reuters) - The U.S. Treasury has told lawmakers a roughly $2 trillion rise in the legal limit on federal debt would be needed to ensure the government can keep borrowing through the 2012 presidential election, sources with knowledge of the discussions said.So the deficit will need to increase by $2 trillion just to make it through all of next year? Lawmakers can't even agree on less than 1% of spending this year and we expect them to seriously tackle a situation like this? I fully expect the debt ceiling to be increased with only a few Republicans dissenting only because party leadership allows them too. They will need to act soon though according to Zerohedge:

The Financial Times is reporting that the Mexican Central Bank bought 100 tonnes of gold between February and March. This comes on the back of a report from the Wall Street Journal that George Soros's hedge fund has been selling off gold and silver:

For nearly two years, Mr. Soros's hedge-fund firm bought gold and silver, becoming the seventh-largest holder of the biggest gold ETF, the SPDR Gold Shares. Some others with stellar records—including Mr. Burbank, of Passport Capital, and Alan Fournier, of Pennant Capital—also have been passionate about precious metals, giving encouragement to individual investors to follow.Rather than buying at the dip, Soros is taking the opposite approach. John Paulson, president of the hedge fund Paulson & Co., is staying strong on gold:

Now they are selling, in each case for distinct reasons.

While many who buy gold do so to protect against future inflation, Soros Fund Management bought gold to protect against the possibility of the opposite—debilitating deflation, or a sustained drop in consumer prices.

But now the $28 billion Soros firm, which is run by Keith Anderson, believes chances of deflation are reduced, eliminating the need to hold as much gold, according to people close to the matter.

A number of high-profile investors remain huge holders of gold and silver, amid continuing concern about inflation and the dollar. Mr. Paulson, known for his lucrative bet against mortgages a few years ago, told investors he still has most of his personal money in gold-denominated funds operated by Paulson & Co.

Mr. Paulson told investors Tuesday morning that gold prices could go as high as $4,000 an ounce over the next three to five years, as the U.S. and U.K. flood the money supply. Gold settled in New York at $1,540.10 a troy ounce Tuesday.So Soros is going against Central Banks all over the world? From EPJ:

China announced in 2009 that it had bought 454 tons of gold over the previous six years; India bought 200 tons of gold directly from the International Monetary Fund in October 2009; and Russia has bought approximately 400 tons on the open market over the past five years.And joining with Steve Forbes, Bill Frezza (another favorite of mine) is predicting a return to the gold standard in his Forbes article today:

I’ll make two predictions with utter confidence. The first is that one day Federal Reserve Chairman Ben Bernanke will be ridden out of town on a rail, joining Arthur Burns in that special circle of hell reserved for monetary debauchers. The second is that in the aftermath of our pending inflationary disaster we will see the gold standard return.Like I said when Forbes made the same prediction, I will believe it when I see it.

Now onto the graphs, first up is a chart from The Economist showing the dollar's decline over the past 40 years:

Rasmussen Reports is out with a report showing that more companies are firing than hiring:

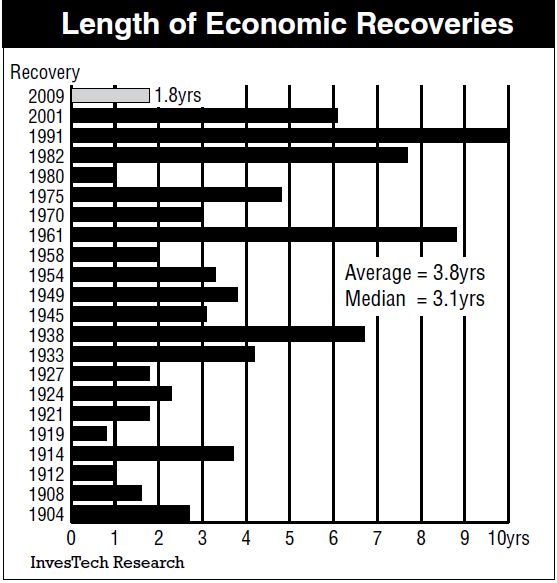

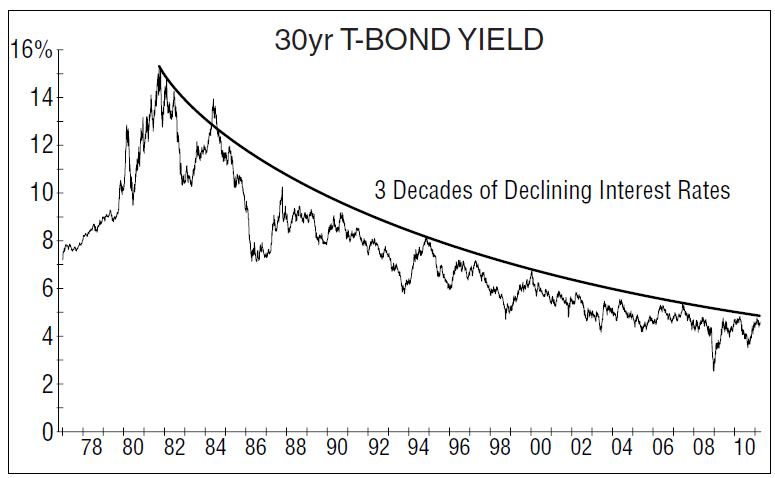

And here are the charts on the correlation between interest rates and economic recoveries from The Big Picture:

You can make your own judgments from the charts, but clearly declining interest rates have not at all stabilized the market judging from the number of recessions we have seen in the past 30 years. So much for smoothing out the business cycle.

To end I will point out two articles by John Stossel and Walter Williams that praise speculators for their work at stabilizing prices. Perhaps they took a page from my article on the subject a few weeks ago...

Oh, and here is Sheppard Smith from Fox News calling out the bin Laden assassination for what it is:

At least someone on the mainstream media is pointing this out.

Tidak ada komentar:

Posting Komentar