Remember this classic exchange between Congressman Ron Paul and Fed Chairman Ben Bernanke?

Anyone with a sense of history for central banking and monetary operations was shocked when Bernanke, with a straight face, declared that gold wasn't money. The silence that preceded Bernanke's answer was deafening. As Paul noted, such a statement disregards thousands of years of historical evidence demonstrating gold's use as money among humans.

As if Bernanke's admission that gold isn't money wasn't bad enough, he went on to timidly suggest that central banks hold gold because of "tradition." Tradition of what you may ask? Confiscating the means by which the public protects itself from endless fiat printing? Or perhaps it's just a shrewd effort to exert the state's dominance in society through the forced use of paper bills containing pictures of past "leaders." Whatever the case, Bernanke, grasping in the dark to defend the system which is losing credibility by the day, deflected with academic shrugging and asserting that people hold gold to protect themselves against "really bad outcomes." From a Fed chairman's point of view, these "really bad outcomes" are never the threat of high inflation or the collapse of an unsustainable fractional reserve banking system. Such an admittance would be blasphemous.

While this exchange between Paul and Bernanke set the economic blogosphere on fire last July, it turns out not all central bankers agree with the Fed chairman's assessment of gold. In lieu of the fiscal train wreck that is Europe, world leaders at the G20 meeting in Cannes, France were rumored to be considering a tapping of the gold reserves held by German's central bank, the Bundesbank, to fund the European Financial Stability Facility. Like maggots to a dead carcass, never doubt the state's ability to find a new source of wealth to dig into. A Bundesbank spokeswoman responded, "we know this plan and we reject;" essentially putting the brakes on such a blatant act of theft for the time being.

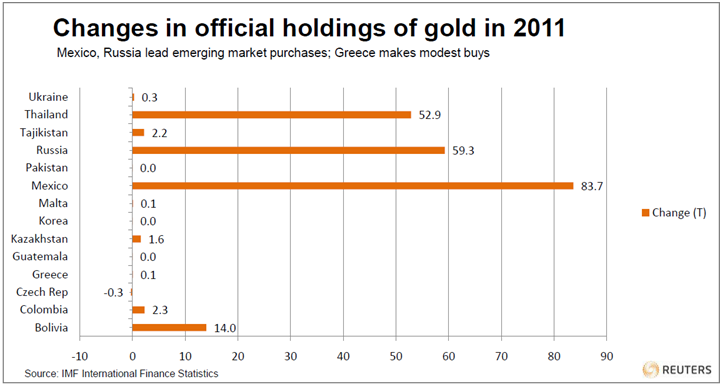

Two things were revealed from such a plan. First, world leaders will go to great lengths to ensure the banks holding euro debt will be bailed out and they aren't afraid to sell Germany down the river to do it. Second, and even more revealing, was that such a proposal shows that gold is money despite the crumbling fiat system by which politicians make their deceitful living off of. According to Goldcore, central banks around the world have been slowly accumulating gold in 2011:

Even with the Bundesbank rejecting the proposal, euro finance ministers are on track to further discuss the gold grab this week. So much for sovereignty in the face of new world order.

While Ben Bernanke attempts to defend the fiat system he represents over an honest currency, his central bankers-in-arms sing a different tune. It only makes sense they want to take advantage of the asset they make all the more attractive through liquidity injections to prop up a corrupt banking system and financing endless government expenditures. With the world's governments actively engaging in a currency race to the bottom, gold will only become more attractive as a currency as Bernanke becomes the Youtube sensation he deserves to be.

Update- Well it looks like G-Pap is finally throwing in the towel after destroying his country and selling the citizens to the banks via Zerohedge:

In actual bad news, the race continues via Bloomberg:

- PAPANDREOU TO STEP ASIDE AS PRIME MINISTER; NEW PREMIER MONDAY

- GREEK PRESIDENCY STATEMENT SAYS PAPANDREOU WON'T LEAD GOVT

- GREEK PARTIES AGREE TO FORM UNITY GOVERNMENT, PRESIDENT SAYS

- GREEK PRESIDENT TO CHAIR MEETING OF PARTY LEADERS TOMORROW

Swiss central bank President Philipp Hildebrand said policy makers remain ready to act in case the franc’s strength increases the risk of deflation and threatens the country’s economy.

The Swiss National Bank expects the franc “to depreciate further,” Hildebrand told NZZ am Sonntag newspaper in an interview conducted Nov. 2 and published today. “Should that not be the case, it could lead to deflationary developments and weigh heavily on the economy. We are ready to take further measures in case economic prospects and a deflationary development should require it.”Remember the days when the leader of a country said things like this? (from Harding's 1920 acceptance speech for the GOP nomination for president):

We will attempt intelligent and courageous deflation, and strike at government borrowing which enlarges the evil, and we will attack high cost of government with every energy and facility which attend Republican capacity. We promise that relief which will attend the halting of waste and extravagance, and the renewal of the practice of public economy, not alone because it will relieve tax burdens but because it will be an example to stimulate thrift and economy in private life.It wasn't perfect but it was a lot damn better than the policies we have today.

Check out this compilation video of the impeccable Jim Grant to end:

Tidak ada komentar:

Posting Komentar