Ms. Nasar divides her book into three "acts," like a play. They are "hope," "fear" and "confidence." "Hope" is what the Victorian thinkers, including Dickens, in his role of social reformer, and Karl Marx (of all people), gave the world concerning the possibility of solving the economic problem through conscious effort. "Fear" is what the interwar economists—confronting first hyperinflation and then the Great Depression—had to wrestle with and surmount. "Confidence" is what returned after World War II, as governments implemented the allegedly constructive notions of the Keynesians and monetarists.

Her collected geniuses, Ms. Nasar claims, were "instrumental in turning economics into an instrument of mastery." I find nothing in these pages remotely to substantiate that contention. Economics may be an "engine of analysis," as Alfred Marshall said, or an "apparatus of the mind," as Keynes put it. But economists no more set the world to producing and consuming than baseball statisticians hit home runs. Then, too, you'll never see Bill James, the dean of the baseball sabermetricians, trip up a base runner the way the government thwarts an entrepreneur. The intervention-minded economists are the ones who give the government its big ideas.Grant is a phenomenal writer, better than most commentators. But what sets him apart is his unrelenting criticism of central banking. The bow tie is a nice touch too.

The best part of the review, besides Grant's brutal criticism of conventional economic wisdom, comes in toward the end though:

I missed, as well, Murray Rothbard, who blamed the Great Depression on the Hoover administration. It didn't intervene too little, Rothbard unconventionally sought to show in his 1963 book, "America's Great Depression," but rather too much. The economics profession just smiled at this contention, but the unsolved case of the depression of 1920-21 counts heavily for Rothbard's thesis. It was a deep and painful slump (a young Army veteran, Harry S. Truman, lost his Kansas City haberdashery to bankruptcy), with the wholesale price index dropping by 37% and the measured rate of unemployment tripling to 12%.Someone on the HuffPost today told me Rothbard was "flaming nutz." That's usually a sign that he was right about most things. I have to agree with Grant on here, "America's Great Depression" is fantastic even if it's filled with loads of data.

MarketWatch had an good article out a few days ago which had a few investors weigh in on 9/11's impact on the U.S. economy. Marc Faber had a very accurate view, like always:

Ed Yardeni also had a very interesting view:“The second consequence of the war is the U.S. dollar is weak. Nobody can tell me the weak dollar is desirable. It’s a decline of the living standards of Americans relative to other countries in the world. The U.S., instead of spending on the war, could have used that money to rebuild crumbling infrastructure.“Without the war effort, I suppose that there might have been less expansionary monetary policies and slower increases in commodity prices. In the second half of 2007 and first half of 2008, the global economy was slowing and in recession, but, because of expansionary monetary policies, commodity prices went ballistic and oil rose. It wasn’t because of demand going up; it was because of artificially low interest rates. 9/11 expanded the willingness of policy makers in the U.S. to print money.”

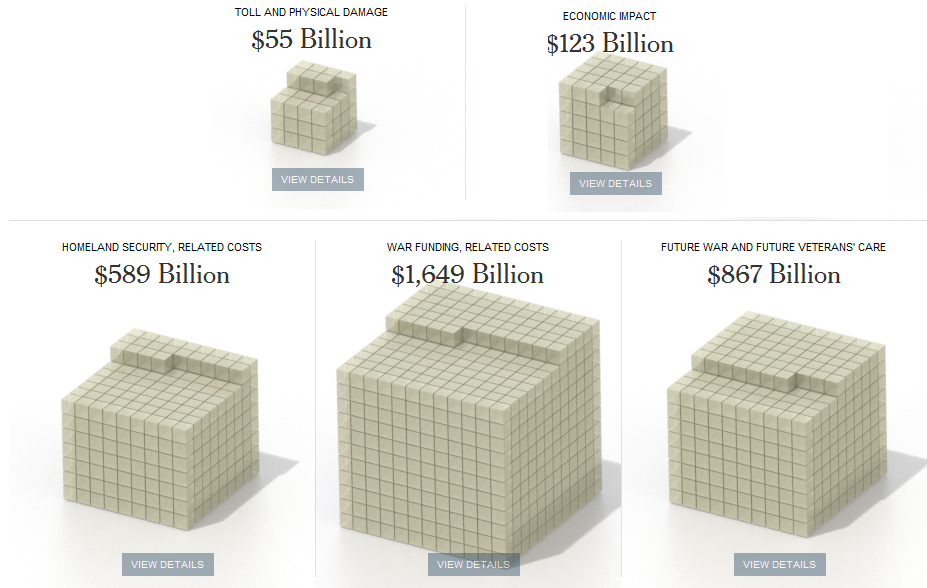

Everybody interview agreed that the U.S. has basically spent itself into oblivion following 9/11. Many thanks due to Alan Greenspan and his genius decision to keep interest rates incredibly low for years. The New York Times has an interactive graphic on what the repair costs of the attack were, click the graphic to link:“The impact of 9/11 was to destroy any semblance of fiscal discipline in Washington at all, and a tremendous widening in the federal deficit and the government’s involvement in the economy and expansion in our overseas military commitments, all under the flag of defending ourselves against terrorism.“In a way the terrorists succeeded in pushing us into doing some very unwise things in Washington with regards to our national finances.

Mark Perry pointed out a recent paper from the World Bank Development Research Group on the growing impact of economic blogs:

"There is a proliferation of economics blogs, with increasing numbers of economists attracting large numbers of readers, yet little is known about the impact of this new medium. Using a variety of experimental and non-experimental techniques, we have provided the first quantitative evidence that they are having impacts.Hmm, looks like the establishment may be getting a bit worried. As I pointed out before, the growing number of economic blogs and blog readership is the market reaction to those looking for a different point of view outside the conventional wisdom of "in case of downturn, print money, if downturn continues, print more money."

I will end by pointing out this interesting comment from Don Boudreaux:

One of the best books on political theory that I’ve read in years is Mark Pennington’s Robust Political Economy. I’ll be writing more about it in the future.When I attended a seminar for the internship program I was in over the summer, I was privileged to witness a few lectures from Mark Pennington and have a fruitful discussion with him over free beer. I was on the sign up sheet to get his mentioned book for free, but the sheet became overfilled and the book was given out randomly. I am still not very happy about that.

Tidak ada komentar:

Posting Komentar