I blame it on the Fed. I blame it on the 1971 decision by Nixon to close the gold window and let the dollar float. Because out of that has evolved -- or morphed -- a central banking policy in the world that absorbs unlimited amounts of government debt. And so we went on what I call the "T-bill standard" or the "federal debt standard." And the other central banks of the emerging mercantilist Asian economies -- Japan, Korea, and now, especially, the People’s Printing Press of China -- have absorbed this massive emission of debt that otherwise would’ve created powerful negative consequences that would’ve forced politicians to act long ago. In other words, higher interest rates, pressure for inflationary monetary policy, and the actual appearance of price inflation. But because all the bonds on the margin were being absorbed by the central banks, we got away for twenty or twenty five years with “deficits without tears.”Well of course there aren't any tears, everyone got fat and happy off the deficits. Why pay for things when the Fed heads can just add a few digital zeroes to bank balance sheets and let freedom ring? Check out his nickname for Bernanke:

As far as I’m concerned, Bernanke is the monetary Darth Vader. He has destroyed the bond market. Because fundamentally, in a healthy capitalist system, the interest rate in the money market and in the longer-term capital market is the price of money and the price of capital.Since Darth Vader ended up saving the day and rescuing his son's over ambitious ass, I don't think relating Bernanke to him is overly accurate. Vader died a hero, Bernanke will almost certainly go down as a complete and utter failure and join Arthur Burns and Alan Greenspan in central banking hell. You see, central banking hell is just like normal hell except Greenspan and the rest of the crew run on treadmills of never ending fiat bills while being whipped from behind by former presidents. Typically Lincoln takes the lead with Nixon at his side. Lucky for them, it goes on for eternity. Here is Stockman on Congress, the banks, and gold:

It’s hard enough for politicians to face the music, to dispense bad news, to make hard choices, allocate pain to constituencies whether it’s spending cut or tax increase. But when the Fed destroys the bond market, which is the benchmark for the whole capital market, and tells the Congress that you can borrow money for two years at eighteen basis points, which is -- as far as Washington’s concerned -- that’s a rounding error. It’s the same as free.

When you’re giving that kind of signal, then there is no incentive, there’s no motivation for people to walk the plank and face down this monster of a fiscal deficit and imbalance that we have. Washington thinks you can kick the can down the road, the debt is more or less free, and we’ll get around to solving the problem. But today, let’s not make any tough choices. That’s where we are.

The banking system has been saved on the back of the savers of the United States. We have totally destroyed any incentive for thrift, for deferred gratification. The Fed has become more Keynesian than Keynes.

Gold is becoming the de facto money. We’re going to be back to a gold standard, one way or another, through the back door in only a matter of time, simply because the central banks are dominated by the ritual incantation of dying Keynesian theory.Stockman is right on every point, the irony being that he used to be a U.S. Rep. himself. He has vindicated himself at this point by seeing the writing on the wall however.

Who hasn't come close to being vindicated for anything however is Mr. Oligarch himself Warren Buffet. After bitching about how he doesn't pay enough in income taxes (no one is stopping you from writing a check to the Treasury Dept. Warren) he now reluctant to bail out other governments, via SF Gate:

Now anyone would be a fool to lend to European banks. It's the equivalent of dousing your money in kerosene and adding a match to the pile. But it's awfully ironic how wiling he is to pay more in taxes to the U.S. government that spends like a drunken sailor than another western democracy. The reason being he won't make money off the deal of course, but we don't want that dirty little secret getting out now.Sept. 30 (Bloomberg) -- Berkshire Hathaway Inc.'s Warren Buffett, who has sold most of his company's holdings of European sovereign debt, said his firm isn't interested in helping to bail out lenders on the continent."They need capital in their banks, in many of their banks," Buffett, Berkshire's chairman and chief executive officer, told Bloomberg Television's Betty Liu on "In the Loop" today. "We would not be a good prospect," he said in an interview from the New York Stock Exchange. He's received "very, very few" calls about putting capital into European banks. "Not quite none at all," he said, declining to name any institutions.

In a bit of end of the week humor, Zerohedge has a report on a wonderful new discovery that will be sure to give Krugman a tingle down his leg:

(Routers) – A remarkable discovery reveals equations that economists say could end the business cycle - forever. Ian Macallum, spokesman for the Royal & Ancient Historical Society of London, told Routers that the equations were contained in an unpublished manuscript which was found in the attic of an 18th century flat in Soho.

"We were skeptical when initially contacted by the current owners” said Macallum. “There is no record of Keynes ever having resided at that address. But we can confirm that the manuscript is indeed an original work of Lord Keynes."

Although very technical in original form, Moody’s Chief Economist Mark Zandi said the final derivation of the equations can be simplified to the following:

“Unless you’re a PhD economist, I think it’s impossible to appreciate the elegance of the final derivation: by raising every stimulus factor to the power of infinity, you immediately move the probability of future recessions to zero. It’s brilliant. The notion that ‘risk’ is a necessary component of free market capitalism will finally be discredited.”There you have it folks! The end all to all end alls! Just shove that handy formula into the super computer at the Fed and we should get all the fiat financed growth we need to get this economy back on track. Even Krugman's wife never brought as much joy to the Princeton Prof. as this formula does!

Federal Reserve Chairman Ben Bernanke was equally sanguine. “I’ve asked some of my fellow academics at CERN to begin modeling the equations with an array of neutrinos, mixed with a small amount of unconventional policy. Even without the helicopter, it should be theoretically possible to achieve an economic growth rate faster than the speed of light. Einstein was a monetarist, so I’ve always been skeptical of his Special Theory. It is now painfully obvious that he should have raised ‘c’ to the power of infinity, not 2.”

“I’m still trying to catch my breath!” exclaimed Nobel Prize winning economist Paul Krugman. “Literally, when I read the equations, I felt a chill down my spine and a tingle in my balls. We can finally end the partisan bickering and get the global economy back on track.”

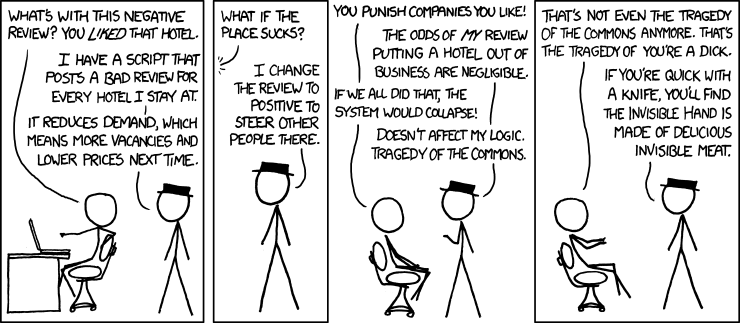

Also in the humor section, this cartoon has been making its rounds around the econblogosphere:

Hilarious.

Tidak ada komentar:

Posting Komentar