Very interesting, via Bianco Research LLC (h/t Big Picture):

A few things of note:

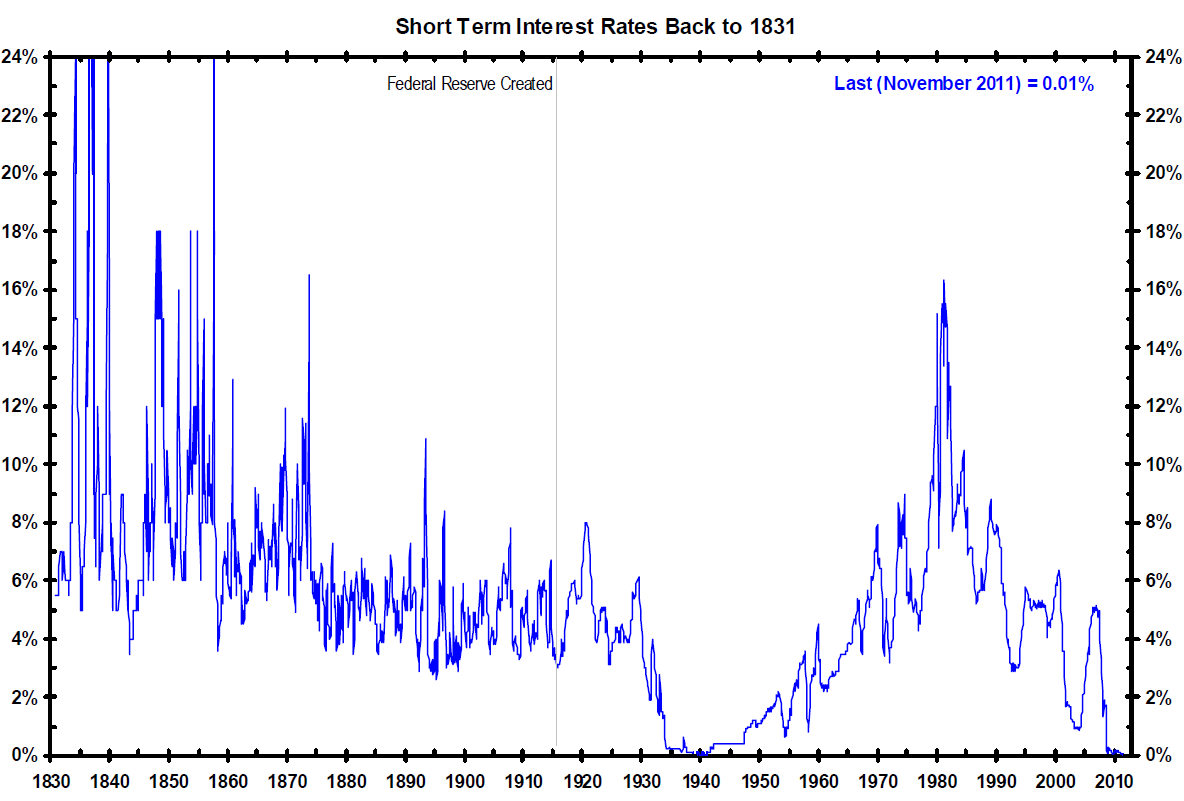

–Look at the rate floor pre-Federal Reserve (1913). It doesn’t appear to go below 3% at all. When I drove my grandmother to a doctor appointment last month, she asked what I had been up to and I replied that I had an article published at the Ludwig von Mises Institute that day. When I told her that LvMI is an economic think tank and educational institution, she immediately asked when interest rates were going to rise again. I had to break the sad news to her but it just goes to show how much of a financial hit many retirees are taking due to negative (in real terms) interest rates.

–Prior to the Fed when financial crises occurred, interest rates were allowed to, get ready for this, rise! The Keynesian orthodoxy of anorexic interest rates to fight recessions didn’t cloud the working order of the market. As for the so-dubbed “Long Depression” of 1873-1879 (you can see the spike in rates following the crash) that some modern Keynesians point to as a rationalization of monetary stimulus during economic contraction, Rothbard blew up this myth in A History of Money and Banking in the United States:

Orthodox economic historians have long complained about the “great depression” that is supposed to have struck the United States in the panic of 1873 and lasted for an unprecedented six years, until 1879. Much of this stagnation is supposed to have been caused by a monetary contraction leading to the resumption of specie payments in 1879. Yet what sort of “depression” is it which saw an extraordinarily large expansion of industry, of railroads, of physical output, of net national product, or real per capita income? As Friedman and Schwartz admit, the decade from 1869 to 1879 saw a 3-percent-perannum increase in money national product, an outstanding real national product growth of 6.8 percent per year in this period, and a phenomenal rise of 4.5 percent per year in real product per capita. Even the alleged “monetary contraction” never took place, the money supply increasing by 2.7 percent per year in this period. From 1873 through 1878, before another spurt of monetary expansion, the total supply of bank money rose from $1.964 billion to $2.221 billion—a rise of 13.1 percent or 2.6 percent per year. In short, a modest but definite rise, and scarcely a contraction. It should be clear, then, that the “great depression” of the 1870s is merely a myth—a myth brought about by misinterpretation of the fact that prices in general fell sharply during the entire period. Indeed they fell from the end of the Civil War until 1879. Friedman and Schwartz estimated that prices in general fell from 1869 to 1879 by 3.8 percent per annum. Unfortunately, most historians and economists are conditioned to believe that steadily and sharply falling prices must result in depression: hence their amazement at the obvious prosperity and economic growth during this era.For a very brief description of the period, see this New York Times article:

Historians long attributed the turmoil to a “great depression of the 1870′s.” But recent detailed reconstructions of 19th-century data by economic historians show that there was no 1870′s depression: aside from a short recession in 1873, in fact, the decade saw possibly the fastest sustained growth in American history.

Employment grew strongly, faster than the rate of immigration; consumption of food and other goods rose across the board. On a per capita basis, almost all output measures were up spectacularly. By the end of the decade, people were better housed, better clothed and lived on bigger farms. Department stores were popping up even in medium-sized cities. America was transforming into the world’s first mass consumer society.–You can also observe the inflationary policies of the U.S. Treasury that lead to the Panic of 1907 (see the decline then spike in rates) which in turn paved the way for the Fed.

–Extreme volatility as a result of laissez-faire economic policy in the latter half of 19th century is often blamed to justify the creation of the Federal Reserve. But one look at the chart shows relatively stable rates from the period following the Civil War to the Fed’s inception- most likely thanks to an adherence to a gold standard (albeit an un-free market one). To see why the financial laisses-faire narrative is a perpetuated myth by central banking apologists, watch Tom DiLorenzo’s great speech on 19th century banking. To see the enormous growth in productivity and wealth that occurred in this period, see Robert Higgs’ “The Transformation of the American Economy.”

Tidak ada komentar:

Posting Komentar