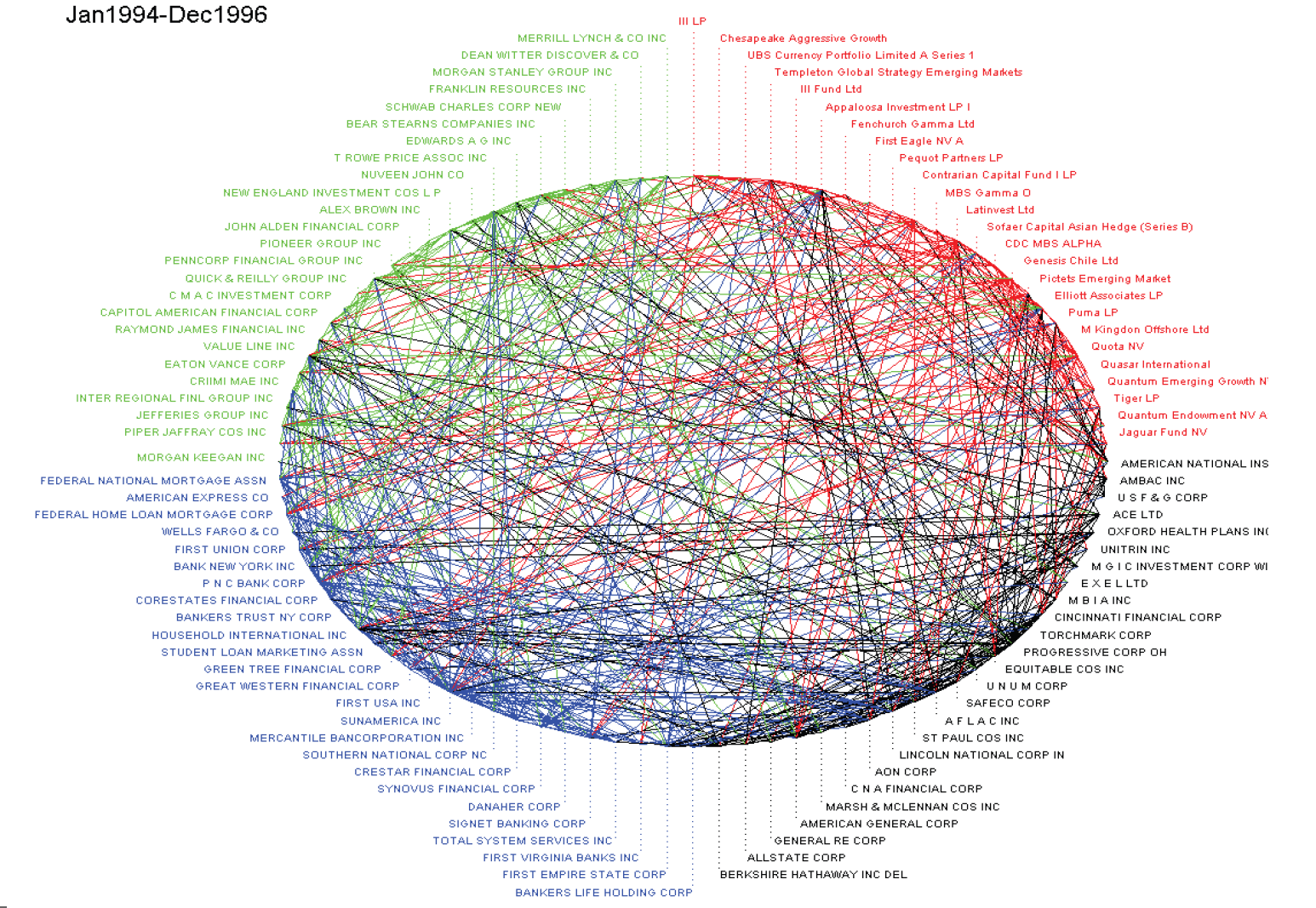

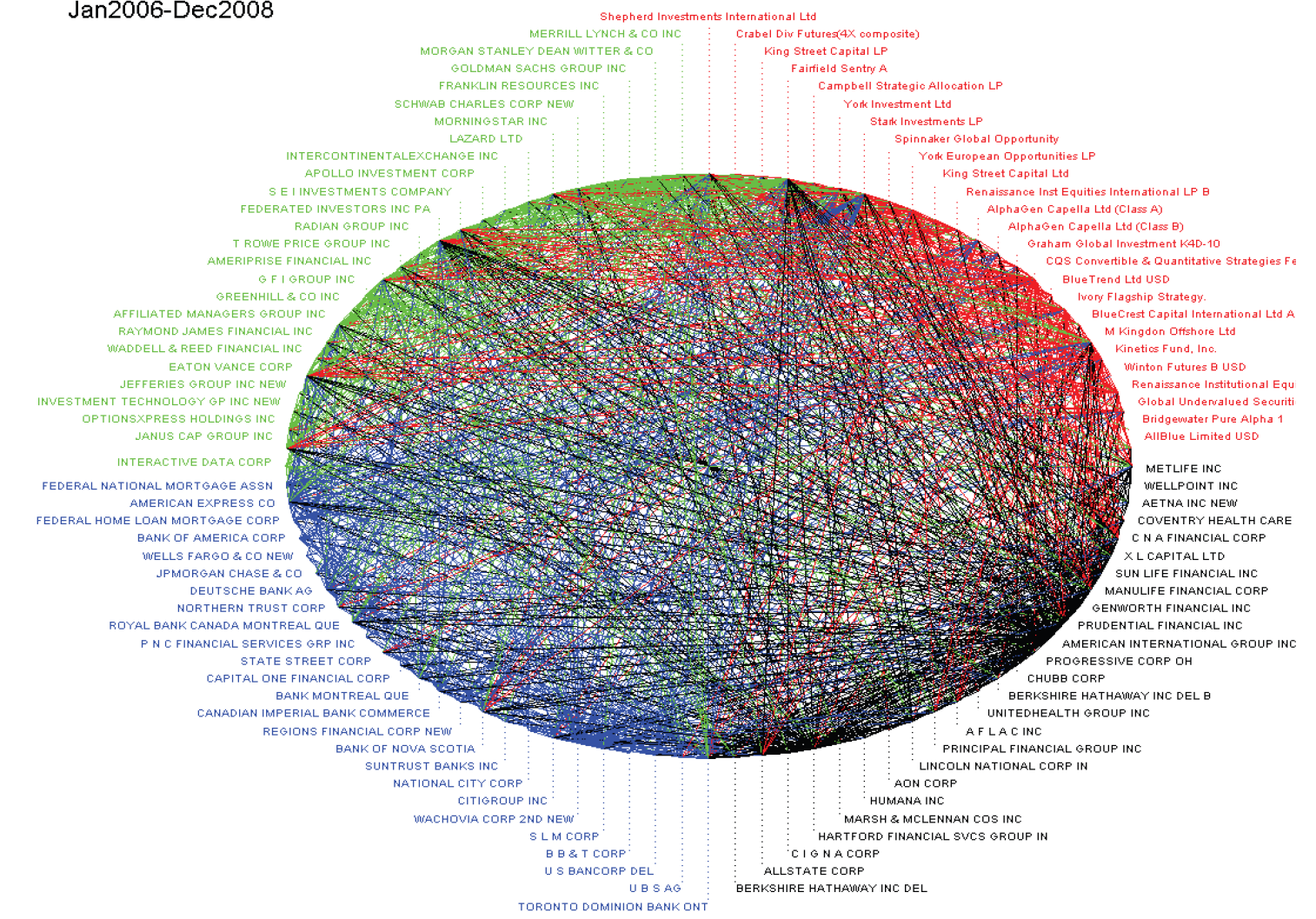

A recently released research paper from a number of economists titled “Econometric Measures of Connectedness and Systematic Risk In The Finance and Insurance Sectors” contains this interesting graphic highlighting the substantial increase in financial interconnectedness over the past 15 years (ht Big Picture):

To the layman or government bureaucrat hell-bent on wielding absolute control over societal function, this incredible jump in financial interconnectedness may send a shudder down their respective spines. It wouldn’t be a stretch to assume this growth is due to an increase in communication technology and globalization. Here is the abstract from the cited paper:

We propose several econometric measures of connectedness based on principal-components analysis and Granger-causality networks, and apply them to the monthly returns of hedge funds, banks, broker/dealers, and insurance companies. We find that all four sectors have become highly interrelated over the past decade, likely increasing the level of systemic risk in the finance and insurance industries through a complex and time-varying network of relationships. These measures can also identify and quantify financial crisis periods, and seem to contain predictive power in out-of-sample tests. Our results show an asymmetry in the degree of connectedness among the four sectors, with banks playing a much more important role in transmitting shocks than other financial institutions.Years after the financial crisis, the cause is still attributed to an unregulated financial industry by those who hold prominent positions in academia and the media. Though there is merit to the “Wall Street went hog wild” argument, the notion that the industry operated in a laissez-faire environment is pure fantasy. George Reisman does a phenomenal job explaining why here.

While some fear this industry interconnectedness because of the systematic risk it presents, this fear should not be based on ideological perceptions of free market capitalism but of the type of “tragedy of commons” guarantee by governments that incentivize extreme risk taking and regulatory barriers that deter open competition in this vital industry.

From a free market perspective, the growth in interconnectedness of “hedge funds, banks, broker/dealers, and insurance companies” is not a phenomena to decry but celebrate. It means market information is exchanged more frequently. The increase in the exchange rate of market information, the sooner relevant information gets in the hands of actors better able to make use of it. The division of labor expands as more opportunities become available through the increase in efficient use of scarce resources. With the implicit backing of the government however, risk-taking takes on a whole new role as profits can be sought without consideration of insolvency or massive losses. Bailouts, besides acting as political fascism in disguise, distort the all-important consequence income loss play in guiding the market process. Firms and companies that fail to make productive use of their assets or shareholder money should, in most circumstances where private investors cease from offering their own funds, undergo restructuring of their operations or cease business all together. Opportunities will always exist elsewhere to displaced workers so long as wages and prices are allowed to adjust uninhibited of market intervention via the state.

Those who advocate for further government regulation of this industry assume bureaucrats, limited by knowledge constraints, are capable of controlling these complex transactions. Hayek spent a a good portion of his career explaining this concept which is summarized in both “The Use of Knowledge in Society” and his Nobel acceptance speech “The Pretense of Knowledge.”

As with any government intervention, such brings a coercive threat into the free transactions of individuals looking to reciprocate one service for another. As Mises elucidated:

It is important to remember that government interference always means either violent action or the threat of such action. The essential feature of government is the enforcement of its decrees by beating, killing, and imprisoning.The only justifiable reason why any proponent of free market capitalism should oppose an increase in industry-wide interconnectedness is not the potential risk it brings by itself but government policies intentionally and unintentionally supporting its growth. Regulation ultimately translates into cost barriers preventing start ups from competing, hence perpetuating cartel like conditions. Bailouts, or their implicit guarantees, give all the reason in the world for those politically connected to profit on extreme risk. Market knowledge disbursement should be encouraged as much as possible. The government’s “hands on” economic policies are what should be fought against for not only the impoverishment they bring but benefits they render to those well connected.

Tidak ada komentar:

Posting Komentar