NEW YORK -- Stocks plunged Thursday in the worst one-day drop in more than two years, as investors absorbed fears that the American economy could enter a new recession.And of course this was the Obama economic team in the White House today:

The Dow Jones Industrial Average dropped 4.3 percent during the day, and the Standard & Poor's 500 Index lost 4.8 percent, as investors dumped risky assets and clambered for safety.

A week's worth of declines in the stock market erupted into an outright plunge as a stream of bad news kept coming: The American economy is barely growing; the federal government is preparing to slash spending; and a growing crisis in Europe increasingly threatens to send shock waves through the system.

Anybody who has been paying attention knew this correction was coming soon. You can bet your Treasury bonds that Bernanke is watching CNBC closely and is getting ready to pull the switch for QE3. Looks like Bank of New York Mellon Corp. is making lemonade with all those flight to lemon security they are receiving, WSJ:

Bank of New York Mellon Corp. is preparing to charge some large depositors to hold their cash, in the latest sign of the worries roiling global markets.

The big U.S. custodial bank said this week in a note to clients that it will begin slapping a fee next week on customers that have vastly increased their deposit balances over the past month.As Robert Wenzel pointed out, this is simply a storage fee. You can't blame Mellon Corp., the money could leave their coffers any second when things calm down. Looks like the dollar survived along with the franc:

The bank cited the heavy dollar deposits it has received over recent weeks, as investors and corporations retreat from financial markets amid Europe's debt crisis and the recent debate over U.S. government borrowing.

It seems like a lot of this was driven by fear of ECB intervention in Italy/Spain bond auctions, but no worries there, the market stepped up and put the kibosh on any future auction of both:

Via Dow Jones we have learned that Spain, not Italy, has decided to pull its August 18 auction and will instead launch its 5 year auction on September 1. Once again, Zero Hedge being just a little prescient with our 7 am commentary that we "look for Spain to follow Italy in a self-imposed bond market exile." And in far worse news, we now get a schism within the European banking authority itself after Bloomberg reported that the Bundesbank's Weidmann is said to be opposed the resumption of ECB bond buying,Now this is unbelievable:

According to a Reuters report, the Italian Treasury has a "larger cash pile than generally perceived according to sources."

Sure enough, the subsequent Reuters headline says that the "Italian Treasury's cash pile is enough to last most of 2011."Translation: Italy is using some funny accounting to avoid any more bond auctions for fear of skyrocketing yields. Like Trichet says, you gotta lie when the financials get hairy.

So as the world economy continues to tumble, Australia is having its own crisis to deal with:

The building and construction industry seems to be bearing the brunt of the brittle Australian economy, with more than 85 companies either entering administration, liquidation or being hit by a winding up notice over the past month in Victoria and New South Wales alone.Can you hear that? Can you hear that PPPPPPOOOOOOPPPPP sound? Another property bubble goes bust, another lesson unlearned. Looks like ignorance of asset bubbles is still a worldwide phenomena a few years after 2008.

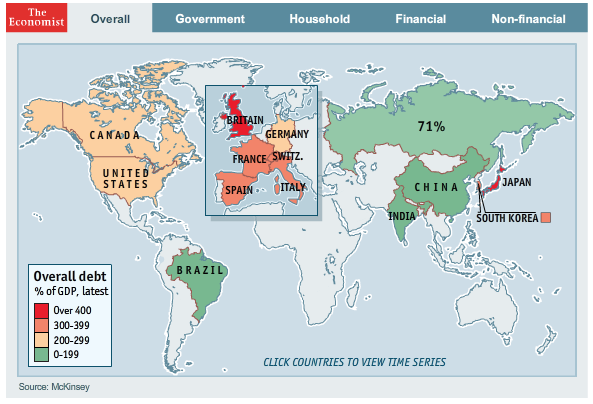

I will end with an interactive graph that highlights the problem of the worldwide economy perfectly: too much debt:

Click the pic for the interactive part, like always.

Tidak ada komentar:

Posting Komentar