"High commodity prices have now created a terms-of-trade shock for importers, feeding into current accounts, the financial sector and, ultimately, sovereign debt. How will these imbalances unwind? Physical gold is the ultimate collateral because it has no credit risk, so EM Central Banks have been diversifying their foreign exchange reserves into gold and other non-dollar, non-euro assets in recent quarters. Looking ahead, the deterioration in credit quality in Europe and the US coupled with an increased probability of QE3 means these pressures will continue. As a result, we revise our 12-month gold target to $2000/oz."Translation: "ECB just monetized Italy and Spain debt, Swiss is hell bent on unconstitutionally devaluing the franc, Japan is devaluing the yen, and QE3 is all but assumed to be on the horizon by the market. Better start treating gold like the currency it was and should be."

The impeccable John Tamny has a wonderful column on RealClearMarkets today outlining the damage dropping the gold standard has done:

Indeed, as Brookes calculated in his essential book The Economy In Mind, "In 1970 an ounce of gold ($35) would buy 15 barrels of OPEC oil ($2.30/bbl). In May 1981 an ounce of gold ($480) still bought 15 barrels of Saudi oil ($32/bbl)." Fast forward to the present, and an ounce of gold ($1750) buys roughly 20 barrels of oil ($85), but given the historical reversion to a 1/15 gold/oil ratio, it's not a reach to suggest that oil is due for a spike upward to roughly $116/bbl assuming gold remains where it is.

So while prices to some degree remain stable measured in gold terms, the fluctuations in the dollar prices of the commodities most sensitive to monetary error have wrought profoundly negative implications. Brookes referenced the "money illusion," and while it can't be quantified, policy is distorted by price signals falsely transmitted through the weak dollar, particularly during periods of monetary debasement.Now main critique of fiat currency regimes is always the use of debasement to pay for loveable welfare programs and perpetual warfare, but Tamny points out another economically damaging aspect of fiat currency:

As for the left who so highly detest financial play things such as derivatives and hedge funds:In short, when money lacks definition, and worse, when monetary authorities lean toward currency weakness, the economy suffers a painful detour into assets of the past that already exist, and away from stocks and bonds that represent income streams from assets that don't yet exist. Adam Smith himself observed that stationary economies are declining ones, and in periods of inflation economies are worse than stationary for so much investment migrating back to the prosaic commercial ideas of the past.Conversely, during periods of relative currency stability and strength (the '80s and '90s stand out here), investment flows to the ideas and income streams of the future. Brookes referred to this as investment in the metaphysical, or the "economy of the mind." Considering the technology explosion that occurred in the '80s and '90s, what happened was not surprising in the least. Strong, stable money equals investment in the future.

To lament hedge funds is to bemoan symptoms as opposed to causes. While hedge funds would have to be invented if they didn't already exist, it's essential to point out that the floating dollar and its inevitable distortion of the money prices of everything made hedge funds ever more necessary. Though hedge funds employ myriad investing styles, one of the most prominent involves taking investment positions based on unrealistic prices.To all the Chris Matthews out there who bemoan the unproductiveness of Wall Street derivatives and risk aversion instruments, fiat currency is to blame.

As I mentioned above, their is a global race to the bottom in terms of currency devaluation. Nouriel Roubini agrees in his new column today:

Currency depreciation is not a feasible option for all advanced economies: they all need a weaker currency and better trade balance to restore growth, but they all cannot have it at the same time. So relying on exchange rates to influence trade balances is a zero-sum game. Currency wars are thus on the horizon, with Japan and Switzerland engaging in early battles to weaken their exchange rates. Others will soon follow.Roubini tends to always be on point when it comes to what central bankers are planning. Check out this dire prediction for the U.S.:

Fiscal policy currently is a drag on economic growth in both the eurozone and the UK. Even in the US, state and local governments, and now the federal government, are cutting expenditure and reducing transfer payments. Soon enough, they will be raising taxes.Warren Buffet is out with an interesting New York Times column today trying to make the case that the U.S. federal government should raise taxes on the super rich:

While the poor and middle class fight for us in Afghanistan, and while most Americans struggle to make ends meet, we mega-rich continue to get our extraordinary tax breaks. Some of us are investment managers who earn billions from our daily labors but are allowed to classify our income as “carried interest,” thereby getting a bargain 15 percent tax rate. Others own stock index futures for 10 minutes and have 60 percent of their gain taxed at 15 percent, as if they’d been long-term investors.Well isn't that just so altruistic of him! Here Mr. Buffet is offering the government to lay its grubby hands on more of his hard-earned income! Like all things the left praises, there is more to the story as Timothy Carney points out:

Buffett Profits from Taxes He SupportsPat Buchanan has a few choice words for Buffet as well: Put your money where your mouth is!

Buffett regularly lobbies for higher estate taxes. He also has repeatedly bought up family businesses forced to sell because the heirs’ death-tax bill exceeded the business’s liquid assets. He owns life insurance companies that rely on the death tax in order to sell their estate-planning businesses.

Buffett Profits from Government Spending

Buffett made about a billion dollars off of the Wall Street bailout by investing in Goldman Sachs on the assumption Uncle Sam would bail it out. He also is planning investments in ethanol giant ADM and government-contracting leviathan General Dynamics.

If your businesses’ revenue comes from the U.S. Treasury, of course you want more wealth.

Why wouldn't the CEO of Berkshire Hathaway want taxes raised to fund an institution that can regulate all its competitive start ups out of business? Buffet is no moron when it comes to earning money.

To round off the pro-government/taxation train today, Paul Krugman has come out with the best government spending scheme yet, pull a alien attack hoax forcing the public to accept the government spending trillions of dollars on an alien defense system! Genius!

Yes Dr. Krugman, let's think about WWII. The government spent billions on tanks, bombs, and guns. Clearly a great deal of wealth was created. After all, it all counted as increased production on the aggregate at the end right?! Krugman's idiocy never fails to amaze like always. As Milton Friedman once said, why pay workers to dig ditches with shovels when we can increase employment by having them use spoons! Jobs for everyone!

I will end with another wonderful example of those angels Krugman trusts to run the country:

WASHINGTON—The 12 lawmakers appointed to a new congressional supercommittee charged with tackling the nation's fiscal problems have received millions in contributions from special interests with a direct stake in potential cuts to federal programs, an Associated Press analysis of federal campaign data has found.

The newly appointed members -- six Democrats and six Republicans -- have received more than $3 million total during the past five years in donations from political committees with ties to defense contractors, health care providers and labor unions. That money went to their re-election campaigns, according to AP's review.As Mish suggests, why not fire Congress and have lobbyists write laws. They already do anyway.

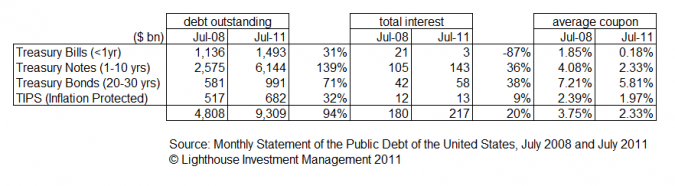

Update- I saw this yesterday and figure its worthy of posting on. Via Alexander Gloy of Lighthouse Investment Management, we have how Bernanke magically makes trillions of debt disappear:

Look very carefully at "total interest" for Treasury Bills in July 08 to July 11

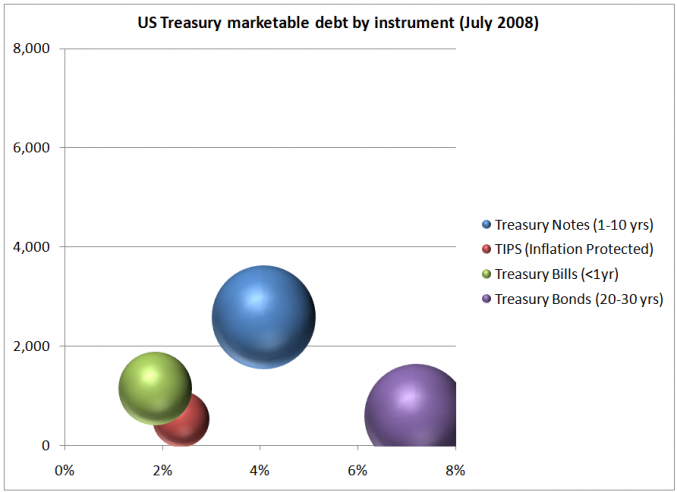

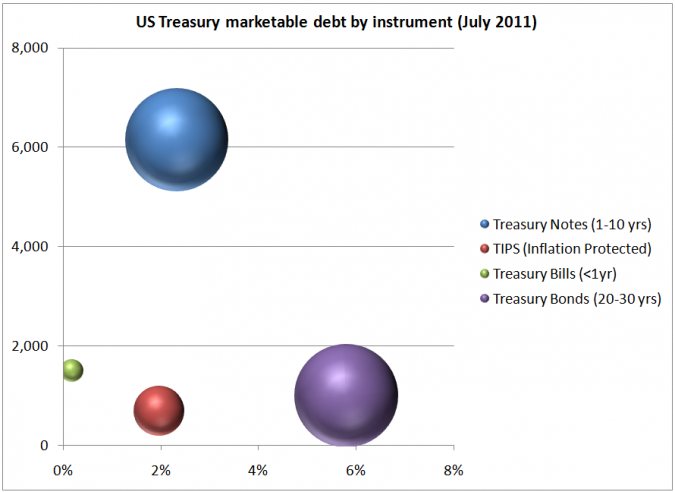

Here it is in graph form, watch the green circle:

Tada!!

The issuer constantly rolls over maturing debt, paying no interest. This is money-printing (and deficit spending) nirvana.So basically the number of outstanding Treasury Bills increased while the interest rate payment went down:

The biggest category (Treasury Notes) saw an increase of 139% in the amount outstanding; yet interest payments increased only 36% as the average coupon dropped.Free lunches don't exist and we are still seeing the consequences of such actions.

Tidak ada komentar:

Posting Komentar