Cellphones!: This seems crazy at first glance. Cellphones are growing faster than ever, with the advent of smartphones from AAPL and GOOG. But eventually (3-5 years), we’ll just have mini-iPads with Skype or gchat on them. The computer and the phone will merge. This is why MSFT’s Skype purchase might be the purchase of the decade. We’ll see. In the meantime, the biggest beneficiary is going to be INTC, trading at just 10x last year’s earnings. It hasn’t figured out this mobile thing yet. But historically, it is always late to a new industry and then dominates it. I have zero doubt the same thing will happen here.The entire college industry: My latest post on this: http://www.jamesaltucher.com/2011/06/i-shouldnt-want-to-be-liked-so-much/ where I detail my most recent public humiliation on this and why I think, again the alternatives to college are going to become much more attractive to parents considering their options.I sure hope he is right about college, but here is the real kicker:

Healthcare providers / medical insurance: Walmart, Walgreens, Krogers, etc., are all experimenting with opening up state by state, inexpensive health-care clinics. These clinics will open up basic health care and will be dirt cheap. Forget about Obamacare, which is impossible to understand and is being overturned by courts all over the place. Walmart-care might be the replacement. Biggest beneficiary will be of course WMT but WAG started the trend and I like them trading at less than eight times trailing EBITDA. Unlike WMT, I think WAG could be a takeover target.I don't agree with Altucher on everything, but he is on to something here. If you take his word for it, and I do, then this could open up all sorts of possibilities for people to get cheap health care without the overhead cost. Look for Walmart to play it smart and get the monopoly on it first though.

I can't help but doubt this bit of wishful thinking though:

The defense industry: Ultimately, the more global the economy, the less need for bigger, better, badder bombs, planes and troops. Think about it: After we get out of Afghanistan and Iraq in (I assume) Obama’s second administration, who else are we going to go war with? There’s nobody. China and the U.S. are going to economically divide up the world and will keep whatever force is necessary to keep the peace, but that’s it. The lobbyists for the defense industry better start looking for new jobs because there’s no need for the next, greatest, nuclear bombs. Bye bye. Biggest losers: Lockheed Martin. The entire alt-energy industry: The alt-energy cheerleaders almost starved the country when corn started being used more for ethanol than food, but that dark part in our history is over. There’s enough oil in the Colorado shales to feed the planet, and fracking in Texas alone could make the U.S. a bigger oil provider than Saudia Arabia. My 10-year prediction on gas prices is less than $1, and that basically puts solar, wind, ethanol, whatever out of business. And we’ll use the nuclear industry for all electricity needs. Biggest beneficiaries: Cameco (the worlds largest uranium producer) and ConocoPhillips, which at less than 4x EBITDA will certainly be acquired at some point in the next year or so.Why without war, how else do we employ so many people right out of high school? Without dropping bombs on civilians, think of all the death merchants that will be put out of work?! Eisenhower was right on the war machine half a century ago and will continue to be right until we finally take the big dive off the fiscal cliff.

So if you still don't think we are continually devolving into a police state, check out this video:

Some background:

On June 22, Reason.tv's Jim Epstein was arrested while attending a meeting of the D.C. Taxicab Commission. The DCTC is pushing a medallion system that would strictly limit the number of cabs in the nation's capital and Epstein's documentary on the awful plan will be released tomorrow at Reason.tv, Reason.com, and our YouTube Channel.Unbelievable. And yet this is where things are headed. Unfortunately most people will continue to put their head in the sand and pretend like it will never happen to them. Shame on the lady who tried to tell everyone to calm down, what happened in front of those tax drivers was not only absurd and horrendous, it was illegal. There should have been more outrage.

Epstein got into trouble when police took another journalist, Pete Tucker, into custody. Epstein, who had been making an audio recording of the meeting for his piece, filmed the arrest of Tucker with his phone (watch the vid above and go here to read more about it all). Epstein spent hours in a holding cell and the government took his phone away before releasing him. The latest word is that all charges against both Epstein and Tucker have been dropped and that they will not be prosecuted.

Speaking of outrage, it looks like Eurogroup chairman Jean-Claude Juncker is finally telling the truth:

(Reuters) - Greece faces severe restrictions on its sovereignty and must privatize state assets on a scale similar to the sell off of East German firms in the 1990s after communism fell, Eurogroup chairman Jean-Claude Juncker said.Damn straight Greece's sovereignty will be "massively limited.' It will be sold off bit by bit to bankers in Germany, France, U.K., and the U.S. until the Greece Parliament grows a pair and tells the banks to screw themselves and accept bond haircuts. So how are 10 year bonds doing with the PIIGS with Moody's downgrade of Portugal yesterday?

In an interview published after euro zone finance ministers in the Eurogroup approved a further 12 billion euro ($17.43 billion) installment of Greece's bailout, Juncker said he was optimistic that measures agreed with Athens would help to resolve the country's problems.

"The sovereignty of Greece will be massively limited," he told Germany's Focus magazine in the interview released on Sunday, adding that teams of experts from around the euro zone would heading to Greece.

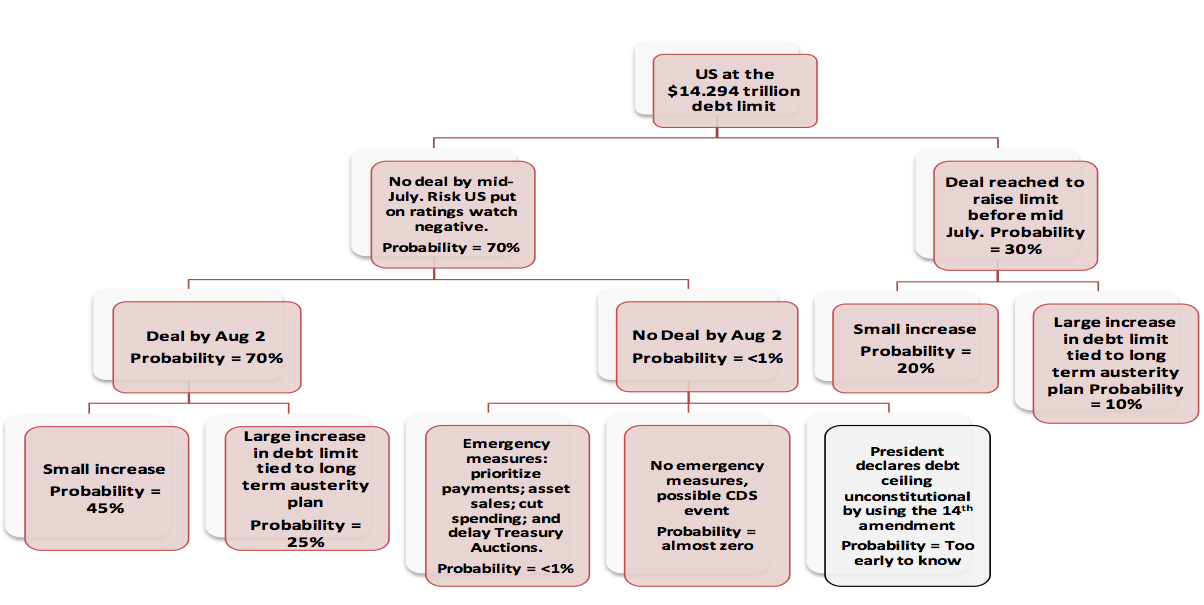

Looks like the market is calling the ECB's bluff yet again. Now if only it would start happening in the U.S. we might see some actual change we can believe in. Check out this handy little graph on the debt ceiling:

Now I am a bit confused on the whole 14 amendment thing and how it makes the debt ceiling unconstitutional, but even if its true, why the hell was this not brought up 100 years ago when the debt ceiling was first created? If the debt ceiling is ever declared unconstitutional, look for bond yields taking off.

I will end with some comic relief, first is Obama's 2012 campaign site getting hack, just check out the pic:

Now there is a campaign message I can get behind! I don't know if this counts as comic relief or just plain depressing but here ya go:

WASHINGTON - Goldman Sachs, Lehman Brothers, and European banks RBS and UBS were the biggest beneficiaries of very short-term Federal Reserve loans extended at the height of the financial crisis, according to data released on Wednesday.Goldman Sachs the biggest winner of all? It's almost like they are in bed with Washington....

The details of the lending program were disclosed after a lengthy legal battle eventually won by Bloomberg News LLP. The data, available on the Fed's website, showed Goldman took $15 billion in exchange for securities ranging from Treasuries to mortgage bonds. Swiss-based UBS AG (UBSN.VX), UK-based RBS Royal Bank of Scotland (RBS.L) and Lehman took $10 billion each.

Tidak ada komentar:

Posting Komentar