Needless to say, this whole thing has ignited a slew of comment threads on the various blogger websites which have brought up the issue. Gary North is out today with an article that I think lays out the issue very well in favor of all those "Rothbard cultists:"

To some, even to play the game of identifying optimal rules for the centralised state monetary authority is to give away the game to the Keynesian social planners. Here's Rothbard on Friedman:This upset our anonymous author years ago. He is just as upset today.In common with their Keynesian colleagues, the Friedmanites wish to give to the central government absolute control over these macro areas, in order to manipulate the economy for social ends, while maintaining that the micro world can still remain free. In short, Friedmanites as well as Keynesians concede the vital macro sphere to statism as the supposedly necessary framework for the micro-freedom of the free market.

In reality, the macro and micro spheres are integrated and intertwined, as the Austrians have shown. It is impossible to concede the macro sphere to the State while attempting to retain freedom on the micro level. Any sort of tax, and the income tax not least of all, injects systematic robbery and confiscation into the micro sphere of the individual, and has unfortunate and distortive effects on the entire economic system.As a veteran of the "free-market movement", I can attest to the remarkable influence of this line of thinking. Now, Milton Friedman was one of the 20th century's great economists as well as one of its most formidable debaters. This made him a powerful check on the influence of anarcho-capitalist Austrians, obviously much to the chagrin of Rothbard. "As in many other spheres," Rothbard wrote, "[Friedman] has functioned not as an opponent of statism and advocate of the free market, but as a technician advising the State on how to be more efficient in going about its evil work." Rothbard's fulminations notwithstanding, Mr Friedman died a beloved figure of the free-market right. Yet it does seem that his influence on the subject of his greatest technical competence, monetary theory, immediately and significantly waned after his death. This suggests to me that Friedman's monetary views were more tolerated than embraced by the free-market rank and file, and that his departure from the scene gave the longstanding suspicion that central banking is an essentially illegitimate criminal enterprise freer rein. When a significant portion of a political movement's activists believe that the whole point of central banking is "systematic robbery", and that inflation is the means by which this robbery takes place, widespread, reflexive opposition to inflation is not surprising.I'll say his influence waned. Why? Because he was a self-conscious disciple of Irving Fisher, the self-professed socialist (if push ever came to shove) and incomparably bad forecaster who announced in September 1929 that the stock market had reached a permanent plateau. He went on to lose his personal fortune (he invented the Rolodex) and his sister-in-law's fortune in the Great Depression. He became a laughing stock among economists, a great embarrassment to the profession. Yet he invented the index number, which is basic to the ideal of targeting inflation by the Federal Reserve System. It was Friedman who almost single-handedly resurrected Fisher's reputation in the 1950s from the grave that it so rightly deserved. Friedman called him the greatest American economist in history.

The Friedmanites, who did not see the crisis coming in 2007 -- but a lot of Austrians did, and said so in print -- were caught flat-footed. They are now enraged at Ron Paul and the Austrian economists. So, there is no hue and cry from Fiedmanites over the massive expansion of the monetary base.

Friedman spent his career devising strategies to make the government more efficient. He was a technician who, as a Treasury Department staff economist, advised the U.S. Treasury on how to be more efficient, beginning in 1943, with his technical support for New York Federal Reserve Chairman Beardsley Ruml's plan to impose withholding taxes on the American people. The government got more efficient, fast. Revenues from income taxes (personal and corporate) quadrupled from $8 billion to $34 billion, 1942-1944.We need less efficient government. Friedman never grasped this. Rothbard did. The few Establishment economists and columnists who have read Rothbard have never forgiven him for this.From what I have read since this whole debacle began, it seems like Friedman was beginning to come around toward the end of his life to the side of Rothbard (and his son and grandson Patri). However you feel about him, Milton Friedman made great strides in promoting liberty and non-liberty. Probably his best contribution for advancing liberty was rigorously advocating for the abolishment of the draft and drug war. His worst contributions toward libertarianism were promoting the idea that the Fed did not undertake enough liquidity-inducing measures at the onset of the Great Depression and the plan he developed for the federal government to withhold income taxes. Whether the gains outweigh the losses, I don't know, but I am inclined to say that the losses were probably greater.

So as the soap opera of the debt ceiling issue continues (that "raging Boehner" didn't get his way last night on getting a vote on his plan, further showing his loss of influence as Speaker) an interesting proposal comes up via Joe Firestone on how to give the Treasury more borrowing room a/k/a more revenue:

So, coin seigniorage looks like a solution to the debt ceiling crisis and also to Congress's requirement, which is the cause of our having a national debt, that the Treasury must issue new debt when it plans to deficit spend. To meet the coming debt ceiling crisis, I think the President ought to use it to preempt the Republican House by doing the following.And what gives the President the authority to take such action?

-- Direct the mint to create a jumbo platinum coin with face value $500 Brillion.

-- Direct the mint to deposit the coin in its account at the New York Federal Reserve.

-- Direct the Treasury to “sweep” the mint's account to collect profits from coinage (this would result in marking up Treasury's account at the New York Fed by $500 Billion).

§ 5112. Denominations, specifications, and design of coins

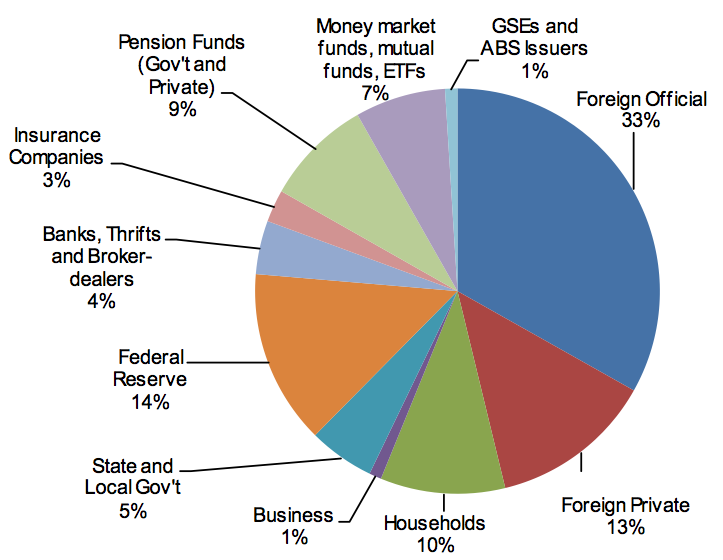

(k) The Secretary may mint and issue platinum bullion coins and proof platinum coins in accordance with such specifications, designs, varieties, quantities, denominations, and inscriptions as the Secretary, in the Secretary’s discretion, may prescribe from time to time.Wow. I am not sure how much platinum the federal government actually owns, but it seems like kind of an accounting trick (which means it will probably work knowing Congress). A better solution would be to sell all the gold, silver, and platinum back to U.S. citizens or foreigners (not other governments) and then allow payments of taxes to be done in precious metal. An even better solution would be an outright default thereby crippling the U.S.'s credit rating and forcing Congress to be adults and start making substantial cuts. That or the Fed will jump in and accelerate the destruction of the dollar. A colleague and I got into a discussion yesterday on who owns U.S. federal government debt. Thanks to The Big Picture, this graph should answer his question:

Jim Rogers weighed in again on the debt ceiling and the coming hard economic times for America in an interview with RT:

Nothing new here, though Roger's assertion that Asia is the continent of the 21st century and that's why he is raising his kids in Singapore so they learn Mandarin is interesting.

Update- Well now I don't know what to think of Milton Friedman, watch this interview with Charlie Rose:

First he calls Alan Greenspan the greatest Fed chairman to ever live, then claims the Great Depression wouldn't have happened if the Fed didn't exist, and then goes to say that Bernanke is a "very able man." It makes me wanna punch myself in the face when Friedman tries to explain Greenspan's genius despite Rose pointing out inflation was creeping in 2005. What I would give to hear Friedman's opinion of Greenspan after the 2008 crash. Friedman may have been a great advocate of individual liberty but fell miserably short when it came to predicting the consequences of monetary policy.

Tidak ada komentar:

Posting Komentar