I have an article in the

Press and Journal this week comparing Harrisburg, Pennsylvania's fiscal situation to that of Greece. They aren't so different if you can believe it:

BANKRUPTCY? Harrisburg suffering from its own big fat Greek debt

by James Miller

Greece is on the brink of bankruptcy.

Political leaders have left the country drowning in millions of euros in debt.

The European Union Fund and International Monetary Fund are providing bailout funds while the Greek Parliament is passing brutal austerity measures that cut back on public sector salaries and benefits and selling many state-owned assets.

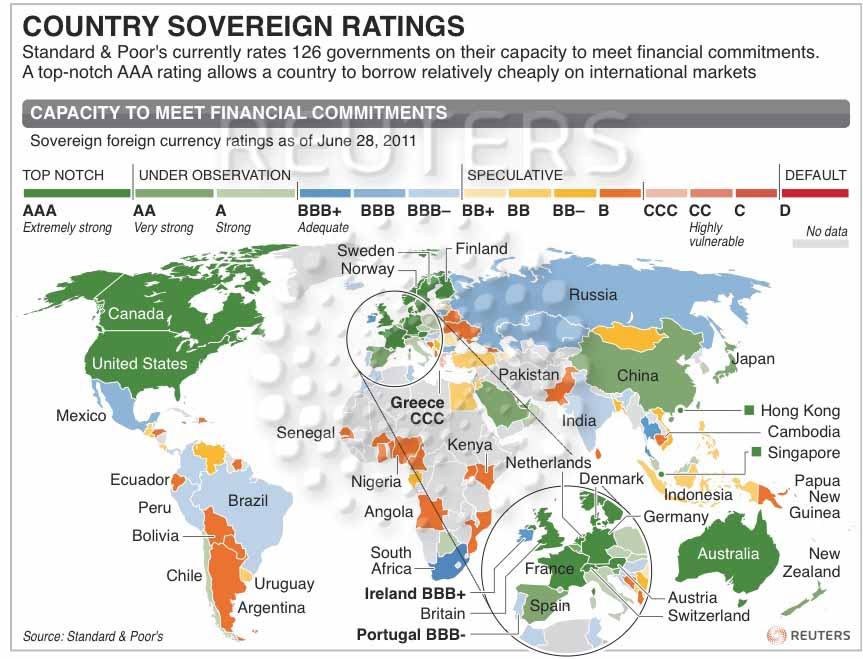

Greece’s bond rating makes it worth less than the paper it is printed on.

Is this ringing a bell for Harrisburg residents?

It is almost eerie how similar Harrisburg's fiscal situation is to Greece's.

While the IMF pushed for Greece to adopt austerity measures, Pennsylvania lawmakers are pushing for Harrisburg's City Council to adopt the state-sponsored austerity measure known as Act 47.

Politicians in both Harrisburg and Greece used faulty accounting maneuvers that have left them awash in red ink.

Greece used the gimmickry to get into the European Union. Harrisburg used it to renovate its infamous trash incinerator which, let's just say, did not come out quite as cost effective as initially planned.

Rigging the checkbook to trick creditors is easy when it isn’t your money to spend. That is a universal lesson politicians learn all too well.

Keeping an impending fiscal crisis under wraps is relatively easy to do in a booming economy. A continual stream of tax revenue usually provides cover for budgetary shortfalls.

If there is one thing we will learn from the Great Recession, it's that the public sector of state, local and federal governments is no longer sustainable without a robust economy. Harrisburg and Greece are learning this lesson more than others.

The kicking of the fiscal can down the road is slowly coming to an end.

Political leaders in both Harrisburg and Greece are going to face the cold, hard truth: As long as the economy remains in the doldrums, there will be default. Plain and simple.

Most economists such as Nouriel Roubini, a/k/a Dr. Doom for his prediction of the 2008 crisis, have declared that a default by Greece is inevitable.

With state Sen. Jeff Piccola pushing through a plan for the state to take over running Harrisburg if city officials reject the state's Act 47 plan for fiscal recovery, it is clear many Pennsylvania lawmakers are convinced that Harrisburg is unable to resolve its problems itself.

Many people know the truth, but those in charge continue to deny it.

Head Euro-Zone Finance Minister Jean-Claude Juncker admitted over a month ago that when dire economic situations become serious "you have to lie.'' And indeed that is what is happening.

Like Greece, the prospect of a Harrisburg bankruptcy would be tantamount to Armageddon, or so Mayor Linda Thompson tells us.

To the contrary, declaring bankruptcy is precisely what Harrisburg and Greece need to do.

Bankruptcy would bring short-term pain but would also put both on more solid platforms by renegotiating labor contracts and imposing haircuts on creditors.

Problem is, both Greece and Harrisburg are now prevented from doing so thanks to the IMF and Pennsylvania lawmakers who care more about preserving their own financial interests rather than the public's financial interests.

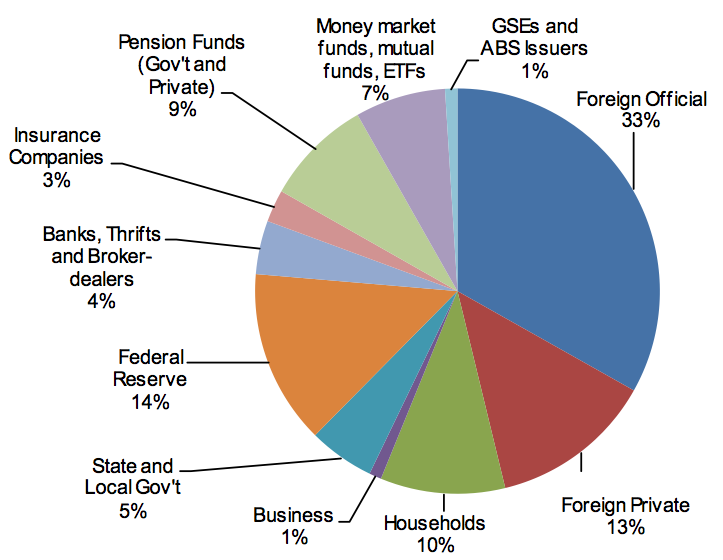

In Greece's case, the government sees a shirking of bondholders as the number-one priority to avoid. These bondholders include major banks in Germany, France, the United Kingdom and the United States. Instead of

Greece, it is really these banks that are being bailed out to prevent massive losses on their holdings of Greece debt.

When it comes to Harrisburg, the holding out against bankruptcy is not for the citizens, but to try and save Mayor Thompson’s and the state’s reputation. No one wants to preside over the bankruptcy of a capital city, especially a mayor or the senator who represents it.

Unfortunately for both, the world economy is beginning to slow down.

China's inflationary-induced growth is starting rear its ugly head.

The Federal Reserve's QEII policy has just ended. It failed to make a dent in the unemployment rate.

Greece may have been bailed out again, but all it did was put another Band-Aid over the crack of a decaying dam.

Once Greece eventually drops the euro in favor of the drachma and puts the printing press on high, Ireland and Portugal will follow like dominoes.

When, not “if,” Spain needs a bailout, all bets are off.

The economic future right now is bleak.

Yet Mayor Thompson and Senator Piccola have opted for preserving their reputations rather than being adults.

Denying the obvious is the equivalent of peeing in the wind.

It solves nothing.

The sooner Harrisburg deals with the crisis, the sooner we can all stop having visions of the Parthenon on City Island.

James E. Miller, a graduate of Middletown Area High School and Shippensburg University, writes political analysis and commentary on his blog, Miller’s Genuine Draft, at http://millergd.blogspot.com.

I should point out that "peeing in the wind" was originally "pissing in the wind," but I think most people will get it.

There were a few good interviews today, first is

Bloomberg with Jim Grant.

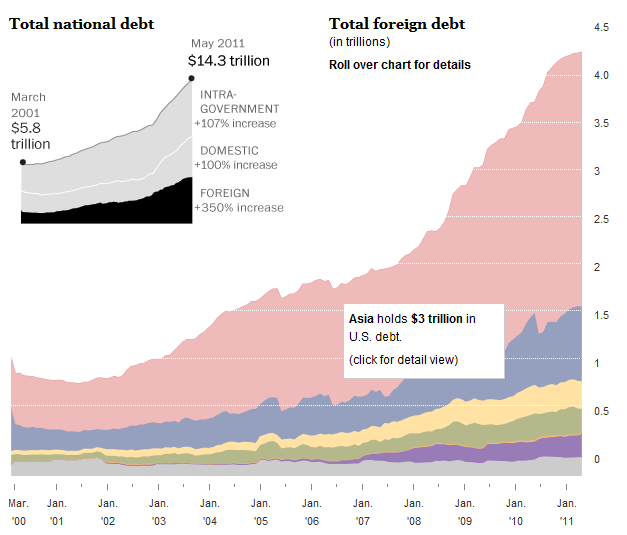

Grant is on point like usual. Yes, we will eventually be returning to a gold standard and yes the U.S. debt ceiling debacle is a sham. The ceiling will be raised, probably in the next few days, and D.C. will continue gorging itself on buying votes. All we will be doing is getting a Mastercard to pay for our Visa bill. That of course would be fraud under most circumstances, but theses are politicians we are talking about. I really enjoy Grant's comment on the thirty year Treasury rally that seems to be lead by an idiotic belief that the Treasury's have some kind of intrinsic value and that the dollar being the reserve currency of the world is not actually a good thing since it comes with so much responsibility. And we know how responsible our wonderful leaders in Congress are.

Next up is a great interview of Doug Casey on the

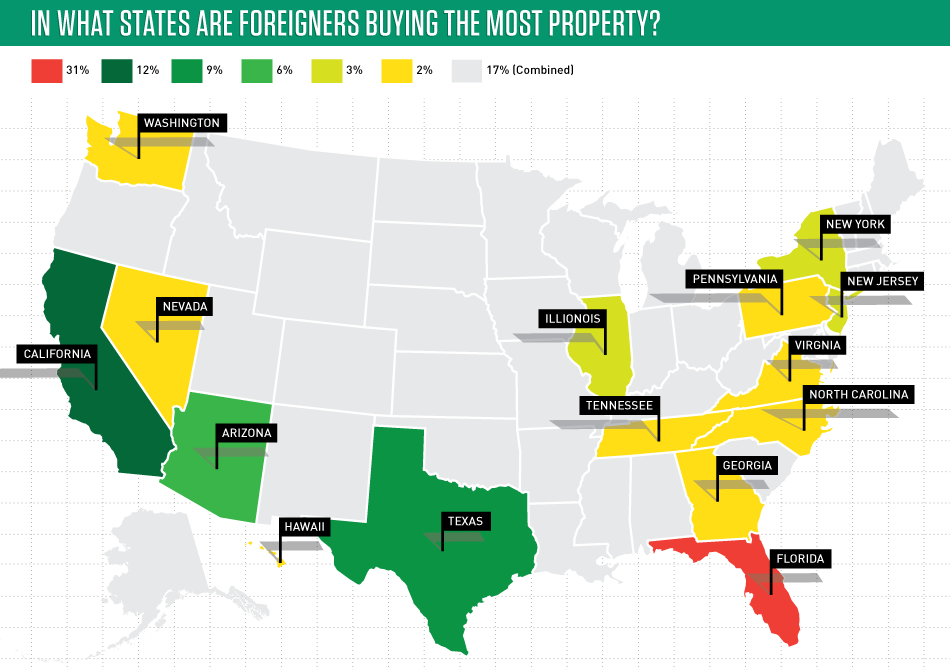

Lew Rockwell Show which I unfortunately cannot imbed. Anything Casey says or writes is worth checking out and this is no exception. To sum it up, Casey basically warns that U.S. citizens should begin diversifying their financial portfolio internationally. Casey and Rockwell both predict another Depression coming which will have high bouts of inflation rather than deflation that carried on through the Great Depression. It will all be followed by another war of course. Now rather than the federal government swooping in and confiscating gold during the Depression, Casey is worried more about financial controls being implemented that keep capital within the U.S. Frankly, this type of prediction is not at all farfetched.

Last is John Taylor with

Bloomberg who predicts gold will hit $1,900 by October and then plummet, can't imbed this one either.

While Taylor may be right about gold, he is another Keynesian quack if he thinks a weaker Euro will benefit smaller countries in the long run and that the dollar will be fine in the long run. Taylor, like Casey and Grant, is predicting a severe economic downturn soon (next year for Taylor) which will be worse than what the world saw in 2008. I love his prediction on QEIII basically financing government "make work" programs but he is overly optimistic if he thinks Bernanke is gonna wait till next year to turn the printing press on again. He doesn't even acknowledge excess reserves that are starting to enter the system. Overall, Taylor makes some decent predictions, but his Keynesian leanings and praise for weak currencies leave him ignorant of any stable economic theory.

Charles Hugh Smith of

Of Two Minds is out with another handy "how to" guide, this time on how to know when housing has hit its bottom:

Has housing bottomed? Here is the sure-fire way to tell:

Stories titled "Has housing bottomed? Here's how to tell" have vanished for lack of interest.

The absence of stories about the bottom in housing will mark the final nadir, because the real bottom can only be reached when everyone has abandoned housing as a pathway to easy money. Only when the public and investor class alike have completely lost interest in real estate as a "sure-fire" investment can the real trough be reached.

Smith also provides these nice graphs to illustrate where we are in the housing market:

I believe Mish has pointed out the above graph before, but it is still worth mentioning. Like most financial analysts, Smith is right that housing has yet to hit its market clearing level but we are getting there.

As many readers know, I am a big fan of contrarian economic views and the impeccable Bill Frezza obliges me today with his wonderful

Forbes article entitled "

Give Greece What It Deserves: Communism" Here are some excerpts:

Once in a great while an opportunity comes along to deliver justice to a people, giving them what they truly deserve. Greece’s time has come.

It must be dawning on all but the most obtuse member of the banking elite that they can’t possibly steal enough money from German taxpayers to save the Greek government from default. Put it off, maybe, but collapse is inevitable.

Once this happens, what is the purpose of casting Greece into some selective temporary financial purgatory where the irrelevant Greek economy can continue embarrassing anyone foolish enough to lend their dysfunctional government a dime? Why not go all the way and give the country what many of its people have been violently demanding for almost a century?

Let them have Communism.

The land that invented democracy used it to perfect the art of living at the expense of others, an example all Western democracies appear intent on emulating. Being the first to run out of other people’s money makes Greece truly ripe to take the next logical step beyond socialism.

As wrenching as it will be we can take comfort in the fact that Greece doesn’t have much of an economy to disrupt. The only Greek industry that’s worth a damn is tourism, rapidly collapsing as travelers get tired of being stranded by strikes while dodging Molotov cocktails. The rest of us can find plenty of other sources of lamb chops, yogurt, and olive oil. They crushed the concept of private property long ago under the burden of environmental, cultural, and social regulations that govern land use. Wouldn’t it be instructive to let them have a go at building a workers’ paradise to remind us what state enforced equality looks like?

Frezza nails it like always. The next logical step for Greece really is communism considering the massive and violent protests going on to preserve government transfer payments and rent-seeking. If they really put their faith in the government, give'em what they deserve!

Update- So you know how Paul Krugman and ilk bitched about the warnings of "death panels" during the debates on Obamacare? Well

this is what we have to look forward to:

‘The NHS was born out of a long-held ideal that good healthcare should be available to all, regardless of wealth. That principle remains at its core. With the exception of charges for some prescriptions and optical and dental services, the NHS remains free at the point of use for anyone who is resident in the UK.’ So says the NHS Choices website itself. But if you smoke or you’re a bit chubby, that statement is no longer true.

n December last year, the Sunday Telegraph reported that NHS bosses in Kent had decided that smokers who required ‘non-urgent’ operations, like hip replacement or cataract removal, would either have to quit before they could join the waiting list or take part in a 12-week smoking cessation course. People with a body mass index (BMI) over 30 – classified as obese – would have to take part in a three-month diet programme in order to get on the waiting list. This week, it seems the idea has spread. According to the doctors’ magazine, Pulse, the NHS in Hertfordshire is planning similar restrictions to the ones proposed in Kent, with smokers and overweight people kept off waiting lists while they mend their wicked ways.

Not exactly "death panels" but its the same concept.

Whenever I argue with others on the

HuffingtonPost (I am at 56 fans!) no matter how many times I try to explain that minimum wage laws cause unemployment, they don't seem to get it. Well here comes William Evan and David Macpherson of

Investor's Business Daily to the rescue:

Our new research, recently released by the Employment Policies Institute, suggests that increases in the minimum wage at both the state and federal level since 2007 are partially to blame for the crisis in employment for minority teens.

Most labor economists will tell you that minimum wage increases lead to decreased employment among workers with the least skills. A survey of more than 100 studies on the subject by Drs. David Neumark and William Wascher confirms this fact: A sizable majority, including 85% of the studies the authors identify as providing the best evidence, show disemployment effects following a mandated wage increase.

Our research adds to this literature while uncovering additional information. Using Current Population Survey data from the last two decades, we focused on males between the age of 16 and 24 without a high school degree — a vulnerable group more likely to be displaced as a consequence of rising labor costs.

With a dataset of more than 600,000 observations, we were able to examine in-depth the employment histories of white, black and Hispanic males. We discovered that not every race and ethnicity was affected equally by minimum wage increases at the state and federal level: Each 10% increase in the minimum wage was accompanied by a decrease in employment of 1.2% for Hispanic males, 2.5% for white males and 6.5% for black males.

So last election cycle, Ron Paul received more donations from active duty military personnel than any other Republican candidate. Most veterans I talk to who aren't incredibly old seem to always agree that our foreign policy is joke. It looks like

the trend is continuing:

Wading through the data in the Federal Election Commission's report for second quarter fundraising this year, activists at the popular Ron Paul website, Liberty Forest, crunched the numbers and reported that their candidate had outraised every single other Republican candidate from sources that list the military as their employer, and had even outraised America's sitting Commander-in-chief, Barack Obama.

Here's the breakdown:

Cain - $6223

Romney - $5000

Bachmann - $2550

Newt - $1025

Pawlenty - $250

Santorum - $250

Johnson - $0

Total GOP (excluding Ron Paul) - $15298.00

Paul - $36739.79

Obama - $28833.99

Update 2- Wow, check out this fascinating

Bloomberg profile on Mr. Big Short himself Michael Burry who famously shorted the housing market before it was the hip thing to do and was paid off handsomely. He was immortalized in Michael Lewis' bestseller "

The Big Short."