Making Political Sense: The Myth of 'Too Big to Fail'

By: James Miller

Published 04/12/2011A large and profitable corporation engages in extremely risky behavior. A disaster occurs. The corporation quickly loses all marketable value.

The government steps in to stop the fiscal unraveling by pumping in billions of taxpayer dollars.

The public is told that if said corporation fails, it will be the end of the world. Profits get privatized while losses are socialized.

The cycle continues. Sound familiar?

Once again, the wondrous notion of “too big to fail” is beginning to rear its ugly head.

Rather than be used to validate the socialistic “saving” of the global banking system, the disaster in Japan will be met with the same type of reactionary response that botched the Hurricane Katrina clean-up effort.

The Japanese government has announced it is ready to offer financial assistance to the owner of the now damaged Fukushima Power plant, Toyota Electric Power Co. (TEPCO).

TEPCO will most likely have a $1 billion bill on its hands whenever the accident at Fukushima is said and done.

This compensation will most likely bankrupt the company. Rather than look at the circumstances that led TEPCO to build a nuclear plant unable to withstand a natural disaster, the government is opting for what it is best at: a handout.

Like the financial crisis, bailouts only serve to reinforce the notion that “big daddy” government is always there to fix everything.

These guarantees only entice banks to rack up billions in mortgage backed securities without worrying about the risk they carry.

In essence, implicit guarantees of support encourage investors to devote capital without proper risk assessment. Making a quick buck becomes easy in the short-term when your losses are protected in the long term. The same concept applies to Fukushima, TEPCO and its financiers.

By bailing out TEPCO, the Japanese government not only sends the wrong signal to the operators of power plants, but to the public as a whole. Bankruptcy of TEPCO will be devastating to both the company and victims whom it owes compensation.

This is the price to pay for building a nuclear reactor unable to withstand a natural disaster. It is the price to pay for those who were willing to live within proximity of a nuclear plant.

Failure is a fact of life. It is a byproduct of the human condition. Protection from failure only inhibits success in the end.

“Too big too fail” is a myth perpetuated by those who have access to the government’s wallet.

Its enforcement needs to end immediately. This is not an issue of legislating barriers to taxpayer money. Barriers crumble as soon as the next disaster hits.

The real issue is one of altering the mindset of the public. Letting TEPCO and its investors fail sends the perfect message: “you failed to calculate the risk involved in building a nuclear power plant, you failed by on your own accord and the public will not suffer by absorbing your loss.”

It will be a tough lesson to learn, but it must start somewhere.

--------------------------------------------------------------

So were insiders betting that TEPCO was too big to fail? New York Times reports:

Japanese regulators and executives of the Tokyo Electric Power Company are asking questions about a seemingly coordinated series of stock purchases two weeks ago that led to an undisclosed buyer or buyers acquiring a large block of the utility, which owns Japan’s dangerously damaged nuclear power plant. Regulators want to know whether the trades, valued at up to $600 million and placed from Hong Kong during the week of April 3, were structured to circumvent Japanese securities laws, which require the owner of more than 5 percent of a publicly traded company to file disclosure papers identifying the shareholder.Robert Wenzel, once again, proves himself right on this:

Was this speculation by a hedge fund operator that Japan would deem TEPCO too big to fail, or was it an inside job by Japanese operators who understood government thinking on the degree to which TEPCO would be protected?

Of course, knowing how government's operate these days, you don't need inside information to understand that the elite will be protected. Those elite certainly included TEPCO bondholders

Now usually Nouriel Roubini is right on most predictions (financial crisis, Greece needing debt restructuring)

but he was proved wrong on one prediction today. From Zerohedge:Gold futures just passed $1,500. Silver touches $43.70. Nobody could have possibly seen this coming (certainly not the shorts). Time for CNBC to break out the "$1,500" hats.Now Roubini from November 4, 2009:

Nov. 4 (Bloomberg) -- Nouriel Roubini, the economist who predicted the global economic crisis, said a forecast by investor Jim Rogers that gold will double to at least $2,000 an ounce is “utter nonsense.”

“Maybe it will reach $1,100 or so but $1,500 or $2,000 is nonsense,” Roubini said.I am starting to like this"nonsense." Granted the prediction was made about a year and a half ago, I wouldn't be surprised to learn that he is hoarding up on precious metals. Oh, and to correct the Zerohedge post that was made earlier today, look at silver now:

Jim Rogers is scared on triple digit silver, he speculates that a bubble may be starting to blow up. The growth that silver has seen recently has been rather worrisome, but he doubts the bubble is happening now. Maybe 2017.

Marc Faber still asserts gold and silver are the "best currency." If silver continues its impressive climb in price at its current rate, Faber may change his mind.

In other news, Canada inflation numbers are in:

A surprise out of the Bank Of Canada, which just announced that despite expectations of CPI coming at a modest 0.6% and 0.2% for the core, inflation was a blistering 1.1%, and 0.7% ex-non core items.What was the dollar's reaction? From Zerohedge:

USDCAD moved a good 50 pips from 0.963 to 0.958 in seconds, giving the dollar another push in the race to the global currency bottom.Now for that funny headline from Zerohedge:

Exactly one week ago, we commented on what many said was a "strong" 3 Year auction primarily courtesy of a 57.4% primary dealer takedown. We also said: "Keep an eye on CUSIP QC7: it will be the most monetized 3 year paper by the Fed over the next 2 weeks." Today was the first POMO operation since last week's auction focusing on 3 year paper. We present the results of the $6.678 billion POMO below. They, and the 28% flip of the entire PD take down, speak for themselves.Ponzi scheme? Well somebody is sure benefiting from the 3-year Treasury flips, and it sure isn't the dollar. Circle jerk is a bit crude, but apt in this case.

I will end with a few tidbits. First is from the U.K. Independent:

A country engaging in war to benefit elite businessmen? If you are surprised, please take off the rose-colored glasses. Here is an interesting graph of Iraq's oil industry:Plans to exploit Iraq's oil reserves were discussed by government ministers and the world's largest oil companies the year before Britain took a leading role in invading Iraq, government documents show.The papers, revealed here for the first time, raise new questions over Britain's involvement in the war, which had divided Tony Blair's cabinet and was voted through only after his claims that Saddam Hussein had weapons of mass destruction.

Government Motors stock takes another dip today below IPO:

Still think we are going to get our money back? Not when Bill Gross still doesn't trust buying Treasuries:

Just to set the record straight following various spurious and less than credible reports floated in the peripheral media this morning, El-Erian sets the record straight on a Bloomberg radio interview.And John Tamny jumps on the high education bubble wagon today in Forbes.

- Pimco's El-Erian says Pimco not buying US treasuries

Update- The Tax Foundation has a graph on sales taxes within the U.S.

Rumor is that Google offered Twitter $10 billion to take it over according to MarketWatch but it hasn't been confirmed.

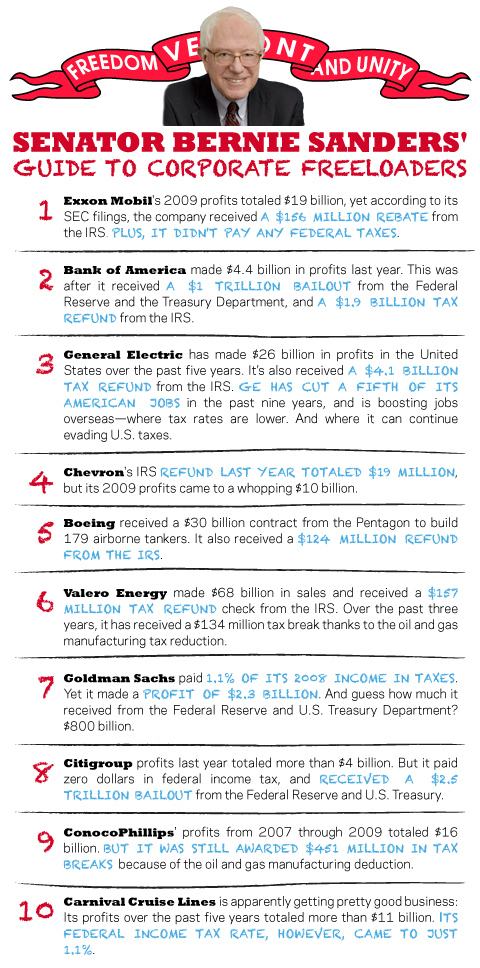

And here is Sen. Bernie Sanders' Guide to Corporate Freeloaders:

Tidak ada komentar:

Posting Komentar