A European bank that received the most Federal Reserve discount window help during the financial crisis received a total of about $300 billion in loans, guarantees and cash infusions from governments and central banks. It also owned subsidiaries implicated in bid-rigging that prosecutors say defrauded U.S. taxpayers.

Details of Fed lending released last week show that Dexia SA (DEXB), based in Brussels and Paris, borrowed as much as $37 billion, with an average daily loan amount of $12.3 billion in the 18 months after Lehman Brothers Holdings Inc. collapsed in September 2008.

By lending to Dexia, the Fed kept money flowing into local government projects throughout the U.S. as well as the money market funds that invested in them. Dexia guaranteed bonds issued by entities as varied as the Texas State Veterans Land Board in Austin and the Los Angeles County Metropolitan Transportation Authority.There ya go, instead of buying municipal bonds directly (which would have the opposite effect of helping because yields would probably soar in light of monetizing debt) Bernanke and crew are doing it indirectly. To be honest, I am not that surprised.

“If Dexia went bankrupt, it could have been a catastrophe for municipal finance and money funds,” said Matt Fabian, a Concord, Massachusetts-based senior analyst and managing director at Municipal Markets Advisors, an independent research company. “The market has extensive exposure to foreign banks.”

Perhaps the biggest news today is that Portugal is no longer denying the obvious. From Bloomberg:

Portugal has asked the European Union for a bailout after a domestic political crisis helped push borrowing costs to record levels, making it the third euro region country to seek a rescue.No surprise there either. It was only a matter of time with yield increases like these:

“I tried everything but we came to a moment that not taking this decision would bring risks we can’t afford,” Prime Minister Jose Socrates said in a televised statement from Lisbon today. “The government decided to make the European Commission a request for financial aid.”

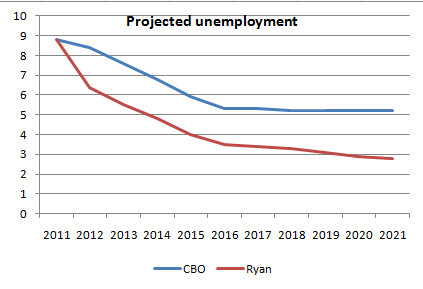

Besides Portugal, Paul Ryan's budget plan has been making quite a stir today. If anyone seriously thought that his proposal would be accurate in the least, you put way too much trust in D.C. Delong and Krugman have already taken their shots (Krugman really went all out on this one, look at all his posts on it). This is my favorite part:LISBON, April 6 (Reuters) - Debt-stricken Portugal managed to sell a billion euros in short-term debt on Wednesday but the yields rose sharply, intensifying pressure from local lenders and ratings agencies to seek a bailout.The sale of 6- and 12-month treasury bills brought temporary relief for the caretaker government in its effort to withstand having to request international aid as the country grapples with soaring rates, political uncertainty and rating downgrades.But the yield on 12-month T-bills spiked to 5.902 percent from 4.311 percent three weeks ago, and on six-month bills to 5.117 percent from 2.984 percent, highlighting the precarious position ahead of big redemptions this month and in June.

Seriously? Unemployment down to 4% by 2015? The CBO tears the plan apart too:

The path for revenues as a percentage of GDP was specified by Chairman Ryan’s staff. The path rises steadily from about 15 percent of GDP in 2010 to 19 percent in 2028 and remains at that level thereafter. There were no specifications of particular revenue provisions that would generate that path.And Mish gets his shots in as well:

No credible proposal can ignore interest on the national debt. I counted 10 instances of the phrase "excluding interest" in the CBO reply.Awww, the "excluding interest" trick, works every time you want to make an unrealistic budget proposal for 50 years down the road. I doubt this will be the end of hearing about Ryan's plan, many Republicans are looking to embrace it. The plan may be overly optimistic, but at least someone is trying.

To be fair, the alternative proposals "excluded interest" as well. However, that only makes Ryan's proposal better than the alternatives, it does not make it any good.

The whole Warren Buffet and David Sokol alleged insider trading scheme is getting a lot of heat these days. While John Tamny and Robert Wenzel have made great cases on why insider trading should not be crime, the idea is gaining steam in the mainstream financial press, see Smart Money:

If the prevalence of insider trading is an awkward truth, here's something more awkward: Even the rule-makers don't always know the rules.It's a pretty good article and worth reading, especially if you think insider trading is a crime.

For example, if a shrewd janitor notices that the typically quiet phones in his company's sales department are ringing wildly, is he a criminal for buying shares? Maybe not, but he knows something material about revenues before the rest of us. A less-hypothetical example: If Wall Street researchers, assigned to figure out whether Apple shares are worth buying, ask overseas suppliers of gadget innards how business has been, should clients who trade on their advice go to jail? So-called channel checks used to be the mark of a thorough analyst. In November, the Securities and Exchange Commission announced it's looking into the practice.

I will end with a few random things. First is an inflation report from EPJ:

Official statistics in Russia show that price inflation in that country is at inflation climbing at annual rate of 9.5% y/y.Here is a good report from BBC on U.K. hospitals denying operation to people who need to lose weight:

Naturally, the true inflation picture is likely worse than the official statistics.

In several areas routine surgery was put on hold for months, while in many others new thresholds for hip and knee replacements have been introduced.

The moves are part of the NHS drive to find £20bn efficiency savings by 2015.

Another way of adding invisible waiting time into the system is to implement stricter new criteria which have the effect of delaying the point when a patient can be referred for treatment. An investigation by the BBC also found evidence in many PCT board papers of new thresholds being added for hip and knee replacements.No doubt the Krugmanites out there will proclaim "the austerity measures in Britain are causing people to lose necessary care!!" Perhaps if they had an option of hospitals to choose from and they weren't all run by the government, they may be able to get the care they need. That's just crazy talk though..

They include introducing scoring systems for patients for pain or disability, or not allowing some obese patients to be referred for surgery until they have been on a weight loss programme.

Here is a nice graph from Zerohedge on the correlation between foodstamp usage and the S& P 500. I am sure there are other factors at work but it really does make you think (especially because the Fed's initial money printing directly correlates into the stock market rising, see my comment in the comment section to see why):

Here is a pretty good video from Daniel J. Mitchell of the Cato Institute:

Oh, and if you were wondering, no the Fed will not shutdown if the federal government does Friday, hooray...

Tidak ada komentar:

Posting Komentar