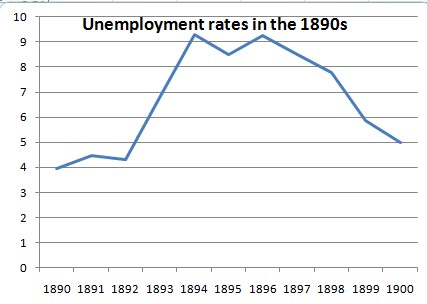

Krugman posts this graph to demonstrate dispel the myth that recessions never happened with a gold standard.

Despite the fact that no one really believes that recessions never happened under the gold standard, the cause of such downturns was the result of fractional reserve banking, not the gold standard. Apparently a 5 year downturn cured through the market correction process is worse than the 20 years of economic stagnation caused by a Fed induced boom known as the Great Depression. From the looks of it, I bet the current recession will last a hell of a lot longer than 5 years as well.

And how exactly was the unemployment rate calculated in 1893? Did the measure account for what I guess would be considered "under the table" work? Considering a lot of the population was transferring into the industrial age but was still very agrarian, did the measure account for that either? I looked on the Historical Statistics Millennial Edition website Krugman claims to have gotten the graph from but didn't see anything to answer such questions.

Tidak ada komentar:

Posting Komentar