(Bloomberg) Treasury Secretary Timothy F. Geithner has signaled to White House officials that he’s considering leaving the administration after President Barack Obama reaches an agreement with Congress to raise the national debt limit, according to three people familiar with the matter.Geithner would be smart to leave soon. We are on the fast track to a fiscal crisis in the next few years and he won't wanna be at the helm borrowing printed money and throwing it at federal programs no politician wants to cut. He will still get his place in history along with Bernanke and Paulson for his role in the crisis. Zerohedge held a survey for people to choose where they think Geithner may head after he leaves the Treasury:

Goldman Sachs

39% (177 votes)

JP Morgan

13% (57 votes)

Any bank that will have him

7% (30 votes)

Tax Consultancy

2% (11 votes)

McDonald's

6% (28 votes)

Any company that will have him

1% (5 votes)

Ive League Professor

10% (47 votes)

Any non-profit that will have him

2% (7 votes)

Extended Unemployment Claims

2% (10 votes)

Solitary Confinement

8% (36 votes)

Other

10% (44 votes)

Total votes: 452

Goldman Sachs is probably where he will go, but solitary confinement would be nice to see. As for my prediction, I think TurboTax will hire him....

QE2 came to an end today, and with it comes some rather strange economic data. First, is the Chicago Purchasing Managers' Index coming in above expectations at 61.1:

A new report from the USDA has pushed corn futures down rather significantly:June 30 (Reuters) - The Institute for Supply

Management-Chicago said on Thursday its index of Midwest

business activity rose in June to 61.1 from 56.6 in May.Economists polled by Reuters had forecast a June figure of

54.0.

(seasonal adj)June May April March Feb Jan

NAPM-Chicago 61.1 56.6 67.6 70.6 71.2 68.8

Production 66.9 56.0 70.0 74.2 78.2 73.7

New Orders* 61.2 53.5 66.3 74.5 75.9 75.7

Order Backlog* 49.3 51.7 62.4 69.6 61.8 60.6

Inventories 46.9 61.6 53.5 60.5 60.2 54.5

Employment* 58.7 60.8 63.7 65.6 59.8 64.1

Supplier Deliveries* 64.8 63.8 68.4 62.7 64.1 59.8

Prices Paid 70.5 78.6 81.8 83.4 81.2 81.7

The * indicates components used to calculate index.

I spent a lot of the afternoon watching CNBC and all everyone was talking about was QE2's demise and how the commodity bull market is over. To some extent they are gonna be right, but they fail to take into account the excess reserves which may be entering the system fairly soon. God knows where we are going from here, but things are about to get interesting. Jim Rogers sure thinks so, here is the video of him warning on the upcoming farmer shortage:WASHINGTON/CHICAGO, June 30 (Reuters) - The U.S. corn supply is far larger than thought and a bumper crop could be on the way, the Agriculture Department said on Thursday in a report that shocked traders and shoved grain markets sharply lower.Farmers defied expectations by planting significantly more corn acres despite rain and floods, and sky-high prices curbed demand which left June 1 stockpiles 11 percent larger than traders had predicted.

I also had the pleasure of watching Mr. I Caused the Housing Bubble himself Alan Greenspan actually complain about QE1 and QE2 ineffectiveness. Here is part of the transcript from the interview:

NOT ONLY QE-2 BUT QE-1 HAS NOT BEEN SPENT. A TRILLION AND A HALF DOLLARS, WHICH IS EXCESS RESERVES HAVE, TO MY ESTIMATION, NOT BEEN SPENT. THE WAY YOU CAN TELL THAT IS THAT THE MONEY MULTIPLIER, A RATIO OF THE EXPANSION OF CREDIT IN THE COMMERCIAL BANKS AND THE MONETARY BASE, WHICH REFLECTS THE EXPANSION OF THE FEDERAL RESERVE BALANCE SHEET, THAT HAS CHANGED NOT AT ALL.Yes, if only we had more credit expansion, then perhaps we can create another bubble to get us out of stagnation. Greenspan is pretending as if the housing bubble never happened as usual. Why this man still shows his face in public is beyond me.

Well here is a nice surprise, Neo-Con Queen Michelle Bachmann is actually in favor of Ron Paul's Fed audit bill. Well I never!

Too bad she screws up on "QE3" unless she is referring to excess reserves, which I highly doubt. I almost hit my hit on the table listening to her try and elucidate economic theory to the crowd. It wasn't exactly bad, just overly simple. Maybe I am just biased for Ron Paul, but its nice to see her follow in Newt's footsteps.

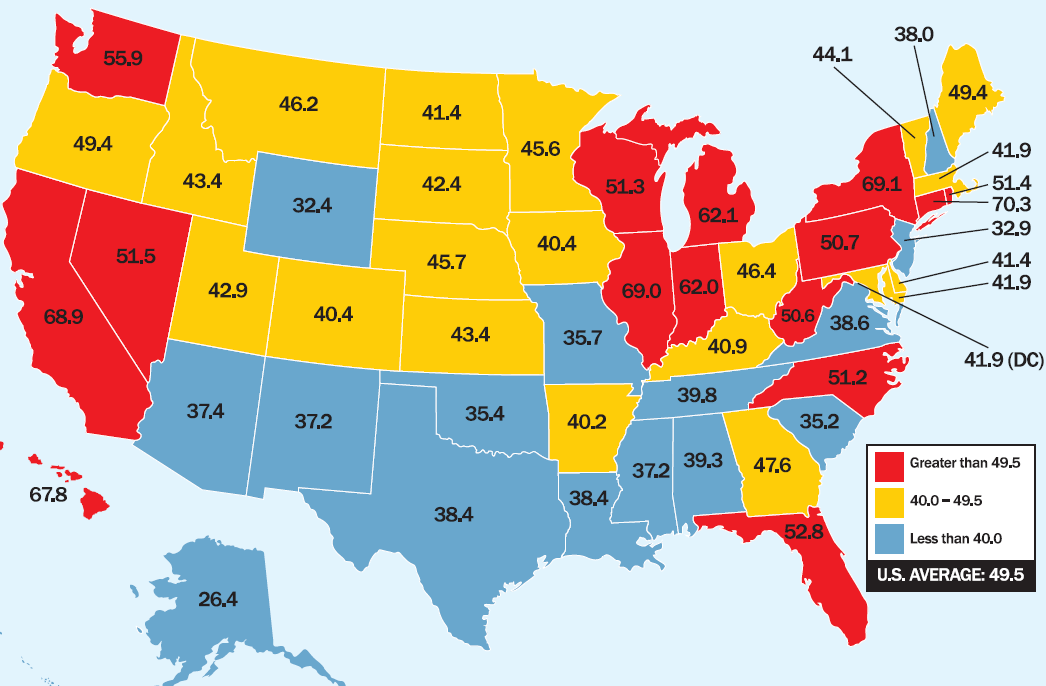

I will end with a couple of nice Mark J. Perry graphs. First is for us Pennsylvanians:

Gov. Corbett should be praised for his resistance to taxing such a prosperous industry, even when he faced opposition from his own party.

Next is that horrible, enslaving business known as Wal-Mart that forces its employees to work in dangerous conditions. Oh wait:

Company | OSHA Enforcement Inspections, 2006-2011 | Employees | Inspections per 100,000 Employees |

|---|---|---|---|

Ford | 389 | 164,000 | 237.2 |

Home Depot | 406 | 189,390 | 214.4 |

Lowes | 247 | 161,000 | 153.4 |

Costco | 99 | 82,000 | 120.7 |

Whole Foods | 26 | 45,300 | 57.4 |

Target | 203 | 355,000 | 57.2 |

McDonald's | 69 | 400,000 | 17.3 |

Walmart | 215 | 2,100,000 (1,400,000 U.S. only) | 10.2 (or 15.4 U.S. only) |

Conclusion: Wal-Mart has a much better safety record than Target, Home Depot, Lowes, McDonald's, Whole Foods, Costco and Ford, when measured by inspections per employee, and therefore gets the Gold Medal for employee safety.

Update: Even after adjusting for Walmart's U.S. employees only (1.4 million), and not adjusting any of the other companies for U.S. employees only, Walmart still comes out ahead with the best safety record per 100,000 employees.